Market Snapshot

Bordeaux is firmly back in the driving seat, accounting for 44.7% of total trade value last week. Lafite Rothschild and Mouton Rothschild lead the charge, reaffirming the region’s dominance even amidst turbulent times.

In terms of global activity, Asia is making a strong showing, tying with the UK at c.28% of total traded value. US buyers, though contributing a more modest 14%, have been selective – focusing their attention on limited-volume, high-value wines from Burgundy and Tuscany.

Deep Dive: Do ‘On’ Vintages Really Outperform?

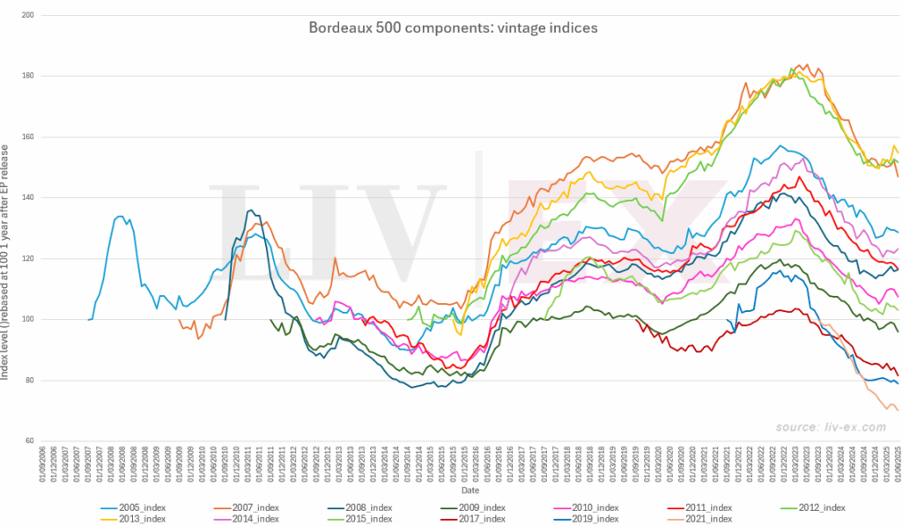

It’s long been assumed that Bordeaux’s blue-chip vintages – 2005, 2009, 2010, 2016 – deliver the best long-term returns. Yet, the data tells a more nuanced story. While these ‘on’ vintages command higher market prices, it’s the so-called ‘off’ vintages – like 2007, 2012, and 2013 – that have delivered the largest percentage gains since release.

Why? These wines entered the market at more realistic price points. When the broader market came under pressure, they had less room to fall. Meanwhile, the highly priced blockbusters of 2009 and 2010 have spent much of the past decade recovering from their En Primeur hype. For today’s buyer, that spells opportunity in overlooked corners of the market – especially where sellers are increasingly cash-motivated.

Where’s the Value Now?

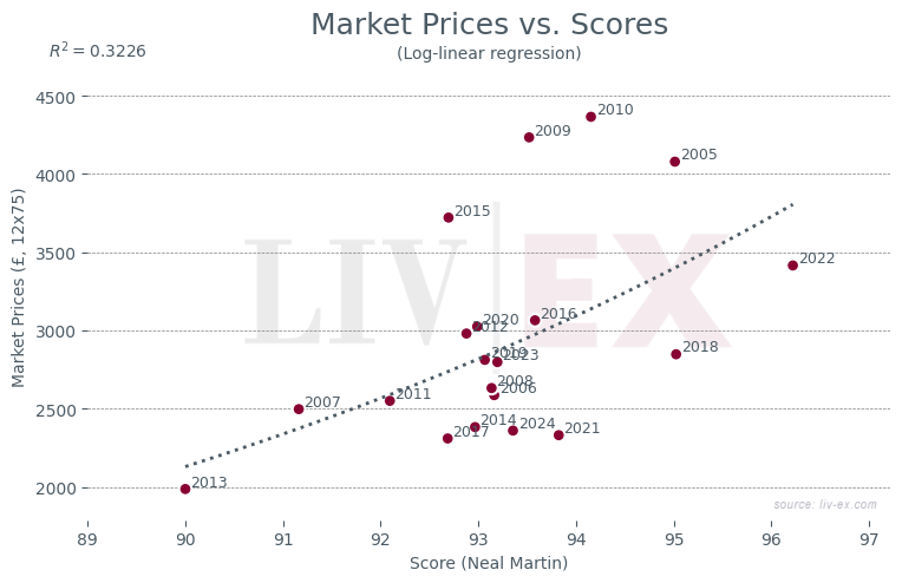

The 2021 vintage stands out. Based on the regression of Neal Martin scores versus average market price for Bordeaux 500 components, the 2021s are trading significantly below their theoretical fair value. Prices have now converged with weaker vintages like 2014 and 2017, despite offering more promise in the glass.

With a bid:offer ratio of just 0.08, the market is flush with 2021 stock. For those willing to look beyond critic hype, this vintage could offer a smart entry point.

Conversely, the 2022s look stretched. Despite stellar scores, their current pricing puts them in line with top-tier vintages like 2005 and 2009. The more settled 2016s may offer a benchmark for where 2022s could eventually land.

The Bottom Line

This remains a buyers’ market. With mature indices stabilising and liquidity pressures mounting on stockholders, value is emerging, but not necessarily where you’d expect. While high-scoring vintages may offer headline appeal, real performance often lies in those that slipped under the radar. For investors with capital to deploy, it may be time to revisit vintages once dismissed as “off.”