“The key challenge this year,” notes Christian Mueller-Glissmann, Head of Asset Allocation at Goldman Sachs Research, “is increasing diversification – across and within asset classes. This is typical of a late cycle investing environment.”

Among the universe of alternative assets, one has been gaining serious traction with high-net-worth individuals: fine wine.

Why Fine Wine?

Goldman Sachs identifies three traits that define smart investment in 2025, all of which align with fine wine:

- Low correlation to financial markets

Fine wine behaves independently from stocks and bonds, providing stability in times of market volatility. - Built-in scarcity

Each vintage is finite. Supply only decreases over time as bottles are consumed, while global demand steadily rises. - Inflation hedges

Fine wine has historically appreciated in value during inflationary periods, much like gold or real estate.

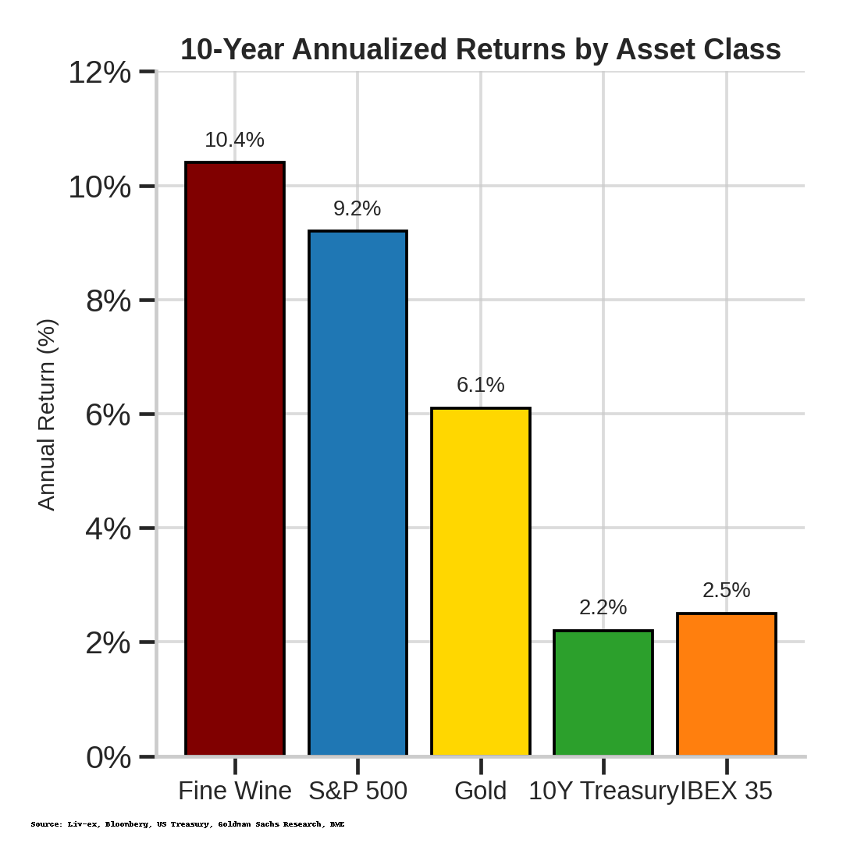

The Numbers Don’t Lie

Over the past decade, fine wine has outperformed most traditional markets:

- Fine Wine: +10.4% annualised return

- S&P 500: +9.2%

- Gold: +6.1%

- 10Y US Treasuries: +2.2%

- Spain’s IBEX 35: +2.5%

Equity markets have become overly concentrated in large-cap tech, while bond returns have been eroded by rising rates. In contrast, fine wine remains a resilient, low-volatility, tangible asset.

Alexandra Wilson-Elizondo, Co-CIO at Goldman Sachs Asset Management, adds:

“We’re in an environment where it makes a lot of sense to add new layers of diversification, particularly in private markets and collectibles.”

The OENO Advantage

At OENO GROUP, we build tailored portfolios of fine wines and collectible whiskies designed for performance, exclusivity, and traceability.

With access to rare allocations, deep market insight, and an integrated exit strategy through global auctions, retail and trade, we provide investors with an alternative asset platform built for the modern wealth landscape.

Fine wine is no longer just a passion. It is a strategy – one now backed by the sharpest minds on Wall Street.

If Goldman Sachs is diversifying into alternatives… why not you?

Get started with your wine investment portfolio today or speak to our team for a tailored consultation.

#GoldmanSachs #WineInvestment #AlternativeAssets #SmartDiversification #PrivateWealth #FineWine #WhiskyInvestment #LuxuryInvestments #WinePortfolio #InflationHedge #SmartMoneyMoves #GoldmanApproved