The opening quarter offered glimmers of resilience – moderate declines, robust trading volumes, optimism surrounding the Bordeaux 2024 campaign, and renewed energy from the US and Asian markets. However, optimism unravelled quickly after Trump’s mid-March threat of 200% tariffs, which triggered an immediate retreat of US buyers. These buyers had been vital supporters of lesser-traded regions such as Piedmont, the Rhône, and Spain, and their exit accelerated the market’s decline. A lacklustre En Primeur campaign (lead by a poor vintage) only compounded the strain, leaving all tiers of the supply chain in precarious positions.

While certain vintages and segments show signs of stabilisation, these remain exceptions rather than the rule. Stability, which the trade had hoped for in 2025, is fighting to emerge against geo-political undertakings.

However, these factors are showing buying opportunities for those thinking long term, especially in the prime side of the market.

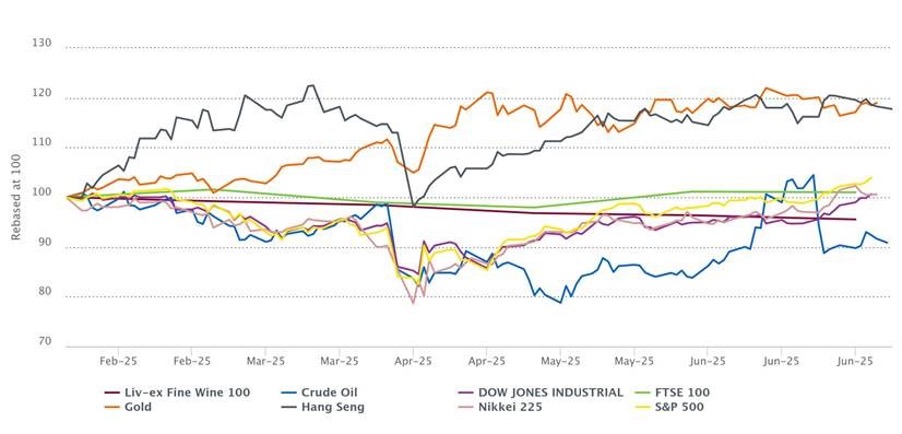

Fine Wine vs. Equities

The turbulence hasn’t been confined to fine wine alone. Global equity markets faced shocks in March but have since rebounded, with major indices in the US, UK, and Germany pushing to new highs. However, many commentators are confused as to why US markets continue to print new all-time highs, when tariffs are set to cause the American consumer pain in the form of higher prices. In contrast, the Fine Wine 100 has lagged behind, outperformed only by crude oil, which has been hit by global economic slowdowns and increased OPEC production. Although crude’s poor performance in 2025 has been a relief to global production input costs.

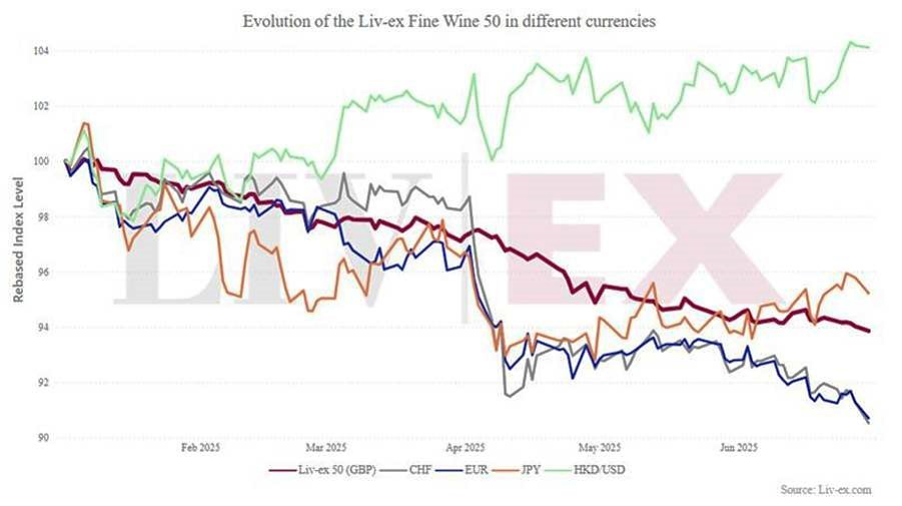

Currency Dynamics and En Primeur Fallout

Currency movements have only added to the complexity. The weakening US dollar against sterling reduced arbitrage opportunities and further dissuaded US buyers. Meanwhile, a stronger euro against the pound has put additional pressure on European participants, forcing Bordeaux producers to slash prices aggressively to maintain global competitiveness. Although, I do believe that this was also prompted by the less than glowing reviews of the vintage as a whole.

This year marked the first time many major US merchants opted out of the En Primeur campaign entirely – a decision shaped not only by tariff fears but also growing disillusionment with the system itself. The rapid depreciation of the dollar against the euro likely played a supporting role in this retreat.

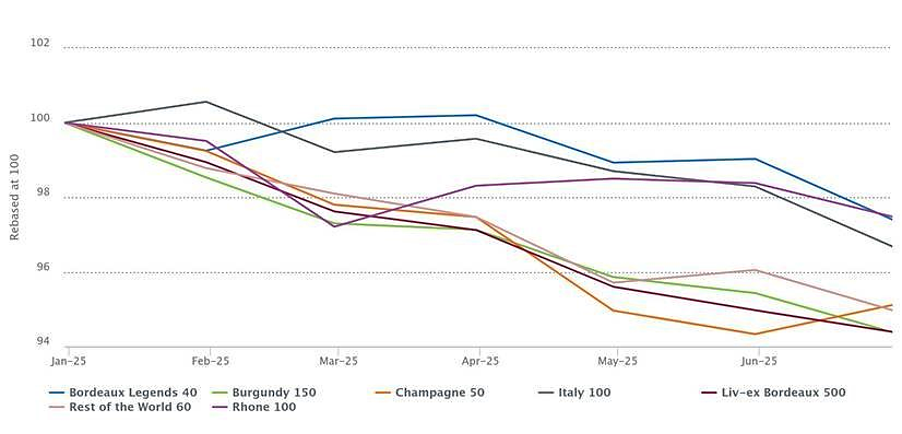

Bordeaux: A Market in Flux

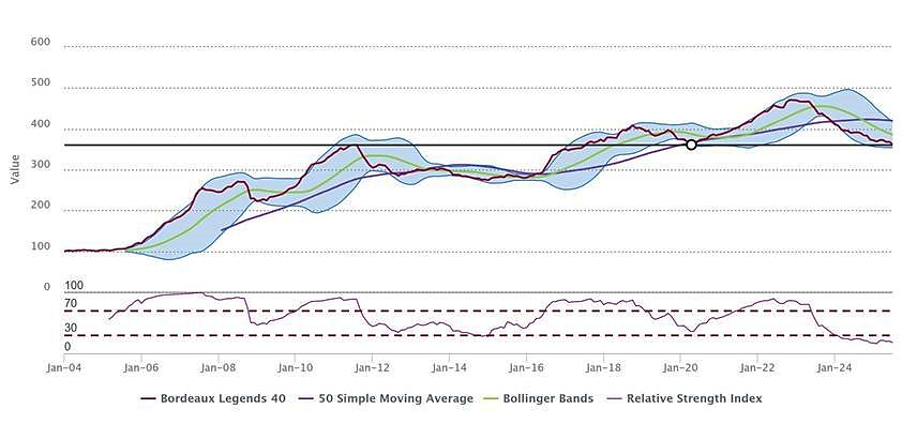

The Bordeaux 500 has been the weakest performer so far this year, down 5.6%. In contrast, the Bordeaux Legends 40 – comprising older, mature vintages – has held up better, down just 2.6%. The divergence is clear: mature vintages have had time to correct and find support, whereas newer releases (2020s, 2021s, and 2022s) have struggled, often trading at record lows below ex-château pricing.

Technical indicators suggest the Bordeaux Legends 40 may be nearing support levels, potentially setting the stage for a rebound. For example, Petrus 2009 dipped to £30,000 per 12×75 in April, matching its 2020 low, but has since climbed towards £35,000, aligning with its 2018 peak. While this does not yet confirm a market turnaround, it does highlight waning bearish momentum.

On the other hand, the Bordeaux 500 remains vulnerable. With little technical support below, further declines – especially among newer, ambitiously priced vintages – cannot be ruled out.

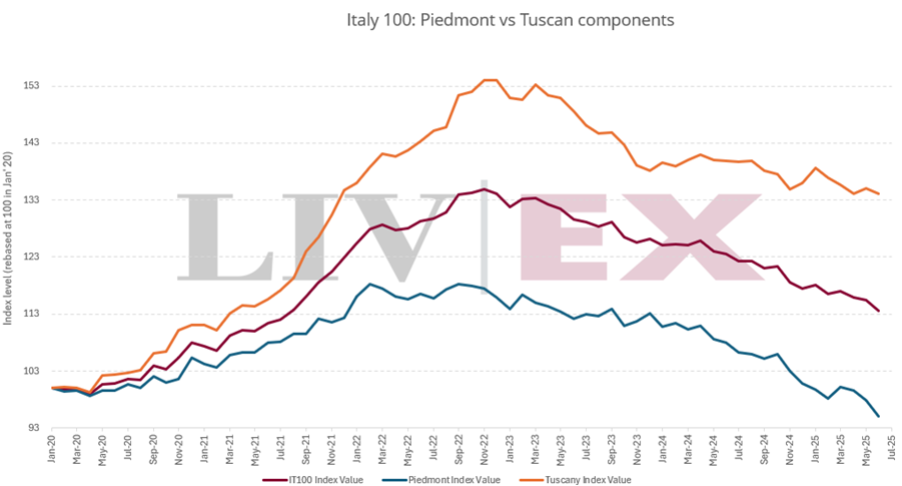

Italy 100: Stability Tested

Long seen as a safe harbour, the Italy 100 index began 2025 on firm footing, only to slide 3.4% in Q2. Within this, a sharp divergence emerged: Tuscan wines (e.g., Sassicaia, Tignanello, Solaia) fell just 1.3%, while Piedmont labels (e.g., Gaja, Conterno, Mascarello) dropped a steeper 5.6%.

This contrast stems from brand power. Super Tuscans, with strong global recognition and broad-based demand, have been better insulated. Piedmont’s reliance on US buyers – who accounted for 44% of purchases in Q1 but just 22% in Q2 – left the region exposed when US participation waned.

Trading Activity: Higher Volumes, Uneven Momentum

Despite falling prices, trading activity in H1 2025 surpassed H2 2024, with volumes up 11.9% and value up 4.2%. However, momentum slowed sharply from mid-April onwards, following the tariff announcement.

Regionally, Bordeaux gained share in H1 2025, while Champagne saw a contraction. The shift reflects US buyers’ recalibration, with a stronger focus on Bordeaux during a period of selective re-entry.

Buyer Geography: US Retreat, Asian Caution

The US market’s pullback defined much of H1’s narrative. Although recent tariff updates could provide clarity, the ongoing uncertainty has kept US buyers hesitant. Once policy is settled, we can expect them to return, albeit cautiously, recalculating margins to account for any new costs.

Meanwhile, Asia has shown tentative signs of revival. Asian buyers accounted for approximately 18% of weekly traded value in Q2, with nominal spending up 55% from H2 2024 – encouraging signs for a market increasingly looking east for support.

Top-Traded Wines: A Glimmer of Value

Château Lafite Rothschild 2021 was the top-traded wine of the half year, rebounding from its En Primeur high of £5,800 to a more stable £3,800. Similarly, Château Mouton Rothschild and Château Lynch-Bages 2021’s saw strong activity, suggesting buyers are finding value in these recalibrated price levels.

Outlook for H2 2025: Patience Required

As we enter the second half of 2025, expectations slightly subdued on the selling side. The market may be inching closer to a floor, as demonstrated by Bordeaux 2021s finding price support and renewed trading interest. There has also been increased buying on the premium side of the market as collectors see value for long term holds. This includes institutional investors, as illustrated by the launch of the Oeno – Fine Wine & Whisky Investment Fund with our partner FundBox.

However, a broader recovery will require a decisive shift in sentiment – likely driven by policy clarity, renewed confidence from Asia, or strategic stock adjustments by merchants. Within the UK market this includes sustained reductions in interest rates and in the US, tariffs are all that US buyers are looking at.

For now, patience remains the watchword if you are looking to sell. If you are looking long term, then deployment is the operative word.