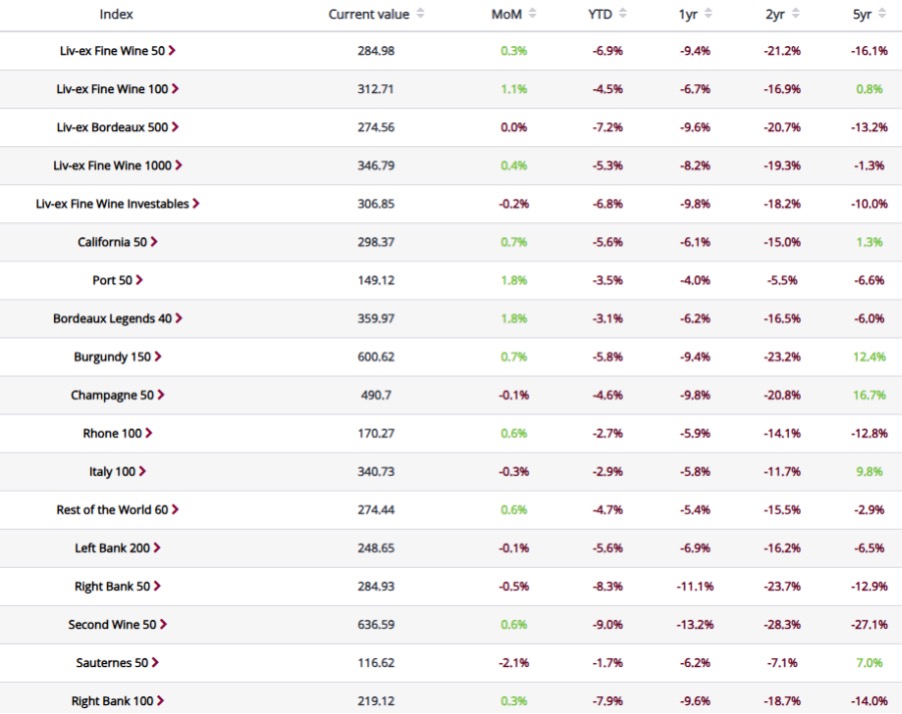

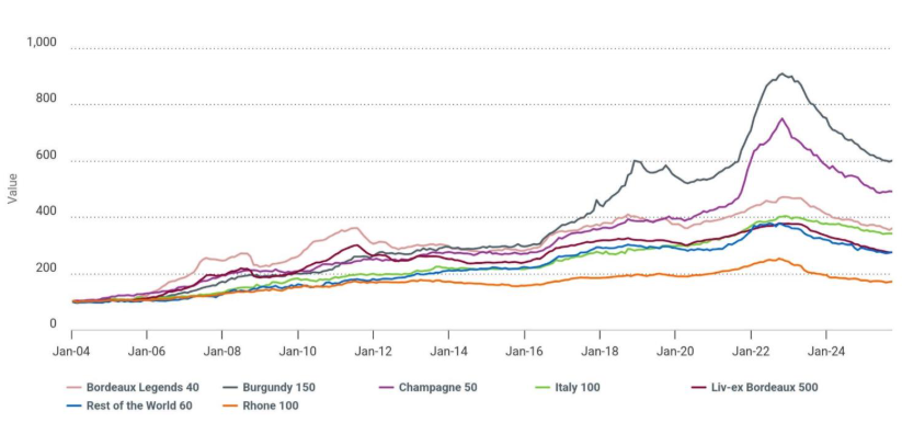

The Bordeaux Legends 40, Burgundy 150 and Rest of the World 60 led the Liv-ex 1000’s sub-indices, while the Sauternes 50 lagged.

Note: The Fine Wine 50, calculated daily, finished September up +0.7% month-on-month — its first positive move in three years.

Trade levels: momentum returns

Trading on Liv-ex strengthened in September, with trade value up 9.5%, count up 4.2%, and volume up 6.4% compared to the Q3 average. Liquidity is now approaching pre-tariff norms, helped by stabilising prices and renewed buyer confidence.

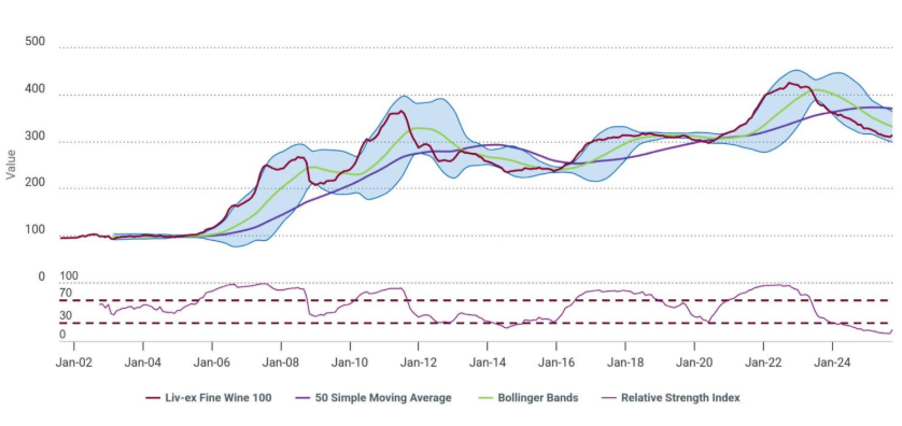

The Fine Wine 100: strongest rise since the market turned

The Liv-ex 100 closed the month at 312.7, matching its 2019 peak.

- 61 wines saw price gains, 1 remained flat, and 38 declined.

- The index’s bid:offer ratio improved sharply — from 0.41 in July to 0.70 now — a level historically correlated with further price stabilisation.

The Fine Wine 1000: recovery led by Bordeaux, Burgundy & ROW

The Liv-ex 1000 rose +0.4%, its best performance since March 2023.

Bordeaux Legends 40 — mature Right Banks shine!

The Bordeaux Legends 40 led with +1.8%.

- Petrus 1990, Le Pin 2009 and Petrus 1989 were the top performers, each rebounding toward their 2020 lows and drawing active trade.

- The Fine Wine 50, tracking First Growths’ latest 10 vintages, turned positive for the first time in three years, with Mouton Rothschild 2021 and Margaux 2015 notable risers.

Burgundy 150 — cautious bounce

The Burgundy 150 gained +0.8%, lifting off its long-term 600 support level.

However, many highly traded wines remain near their 2020 lows, suggesting the region may not have fully bottomed.

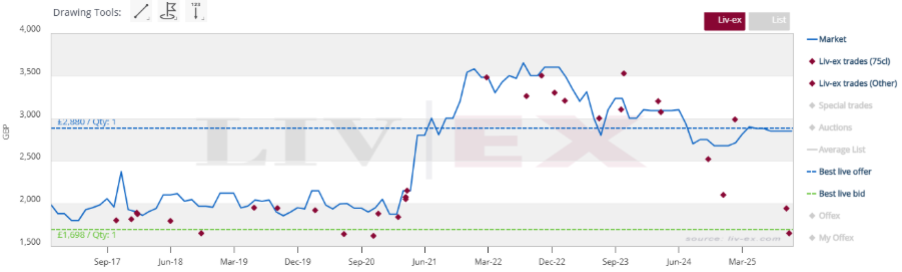

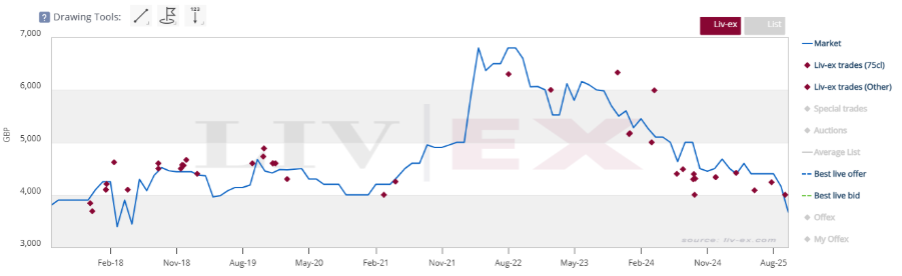

Liv-ex trades of Clos des Lambrays 2015

Liv-ex trades of Clos de Tart 2015

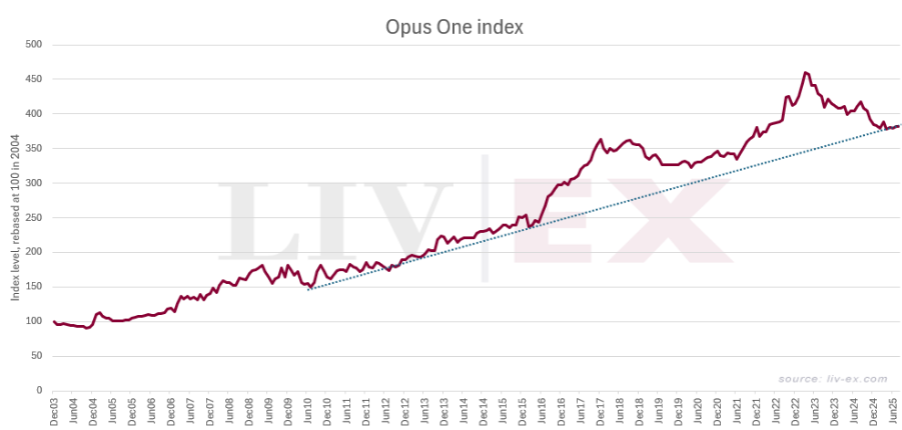

Rest of the World 60 — Opus One drives gains

The ROW 60 rose +0.6%, powered by Opus One.

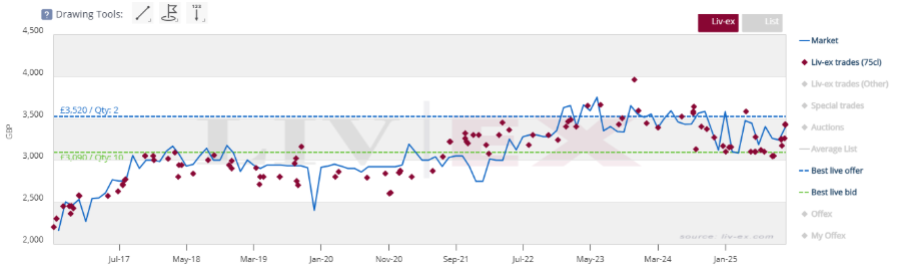

- Every vintage of Opus One advanced in September, with the 2013 vintage the most traded on the exchange.

- Prices appear to be finding technical support along the index’s long-term trendline.

Liv-ex trades of Opus One 2013

Sauternes 50 — prices fall, but buyers return

The Sauternes 50 dropped –2.1%, the weakest sub-index this month.

Yet, trade volumes hit their highest since April 2024, hinting at value buying despite shifting consumer preferences.

Italy 100 & Champagne 50 — mild pullback

Both indices eased slightly after a strong run:

- Italy 100 remained broadly flat over the past three months. Within it, Ornellaia held firm, with only the 2021 vintage slipping (–0.3%).

- Champagne 50 dipped but is still +1.0% YTD. Notably, Jacques Selosse Millésime — one of the hardest hit labels during the downturn — saw an uptick in trading activity.

Key takeaway

September’s data points to improving market breadth:

- Bid:offer ratios are recovering.

- Trade levels are approaching pre-tariff volumes.

- Core regions (Bordeaux First Growths, mature Right Banks, Opus One) are finding support near 2020 levels.