Experience a rare evening of Italian white truffle and exceptional...Read More

Fine Wine Investment

London, 25 June 2025 – This year, we at Oeno Group proudly marked our 10th anniversary with a truly unforgettable celebration at our home, Oeno House, in London’s Royal Exchange. Curated in partnership with Red8 Gallery, the evening was designed as an immersive experience, bringing to life the key milestones that have shaped our journey so far.

Welcome to the World's Number One Wine and Whisky Collection Platform

Over the past few decades, fine wine and whisky have proved themselves as highly profitable alternative asset classes, making it an attractive addition to many portfolios. A 2019 survey by Barclays Wealth and Investment Management revealed that over 33% of high-net-worth individuals have fine wine as part of their portfolio, allocating roughly 2% of their wealth in these collections. With rising market uncertainties and fears of recession, conscientious investors have quickly realised how fine wine and whisky’s unique attributes offer incredible growth potential for returns and are an intelligent way to diversify your portfolio.

The primary motivation to collect fine wine and whisky lies in its stable yet impressive track record. As they are both asset-backed, fine wine and whisky are often compared to gold and are rarely affected by stock market fluctuations.

5 SIMPLE steps

to INVESTING

ARRANGE A MEETING WITH YOUR DEDICATED WINE & WHISKY TRADER

YOUR TRADER WILL CURATE A BESPOKE COLLECTION FOR YOU

PURCHASE YOUR COLLECTION AND RECEIVE YOUR CERTIFICATES OF AUTHENTICITY

WE’LL INFORM YOU OF THE OPTIMAL OPPORTUNITIES TO SELL

CHOOSE RECEIVE YOUR RETURNS OR ALLOCATE MORE ASSETS TO YOUR COLLECTION

Collecting with OenoFuture is an extremely simple and easy-to-understand process for both experienced collectors and those just beginning their journey in fine wine & whisky. Throughout the process, clients can be reassured that they will be fully informed about when, why and what to collect.

Our EXITSTRATEGIES

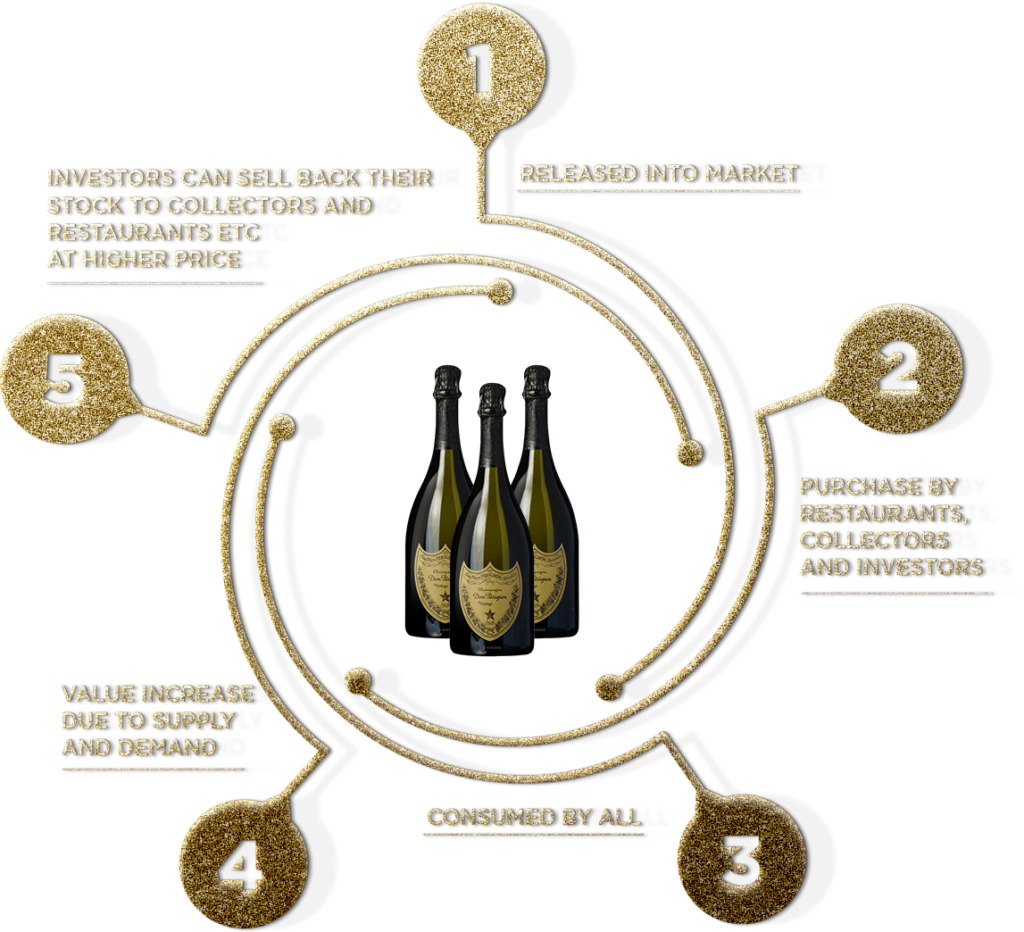

Fine wine & whisky are two of the rarest asset classes with a full circle life-cycle. This means they are produced in limited quantity, collected, and ultimately consumed. Therefore, a comprehensive exit strategy is absolutely imperative to showing your returns from your collection.

Oeno Group is structured to optimise the opportunities in both fine wine & whisky. Clients have access to the world’s finest and rarest of both of these asset classes via OenoFuture, and they enjoy access to customised exit strategies through UK hospitality via OenoTrade, or through our e-commerce platforms and our luxury boutique OenoHouse.

Our RETURNS

Panton Accountancy Services Limited can confirm that OenoFuture Limited has generated the following average returns on behalf of its clients over the years 2019, 2020, 2021 and 2022.

2019

11.02%

2020

12.10%

2021

15.56%

2022

15.35%

2023

9.90%

2024

7.10%

Client REVIEWS

Great alternative investment

Great time meeting and drinking some very nice wine with your experts. Really fun to sit and discuss the long term appreciation of different wines and whisky.

Blake

Verified

Such a good day at OenoHouse

I had such a good day when I recently visited OenoHouse with some of my pals. It was a really enjoyable experience which involved us tasting some great wine! We will definitely be going back there when we are all next free again!

Mac

Verified

Meet my portfolio manager

It was my chance to meet my portfolio manager Sid, and he answered all my questions, making me feel more conforfortable about progressing with it. Although it rained at OENO house, it was a good and relaxing atmosphere.

John

Verified

Excellent professionals with true knowledge of their industry

The OenoFuture executive Bailey Cooke, took time to explain the features of the investment transaction through a few conversations and answered all the questions had about the industry.

Beatrice

Verified

Invest in Wine, it is worth it

I was introduced to the Wine investment world by Oeno Wines and more specifically my broker David Alvarez. I had some extra funds from work savings and needed to diversify my portfolio.

Guilherme

Verified

Events

OENO FUTURE

Lisbon

OENO FUTURE

Madrid

OENO FUTURE

Venice

Sign up today

2500+

6

$83m

OurSTORAGE

London City Bond (LCB) specialises in storing fine wines for the trade and private clients in purpose-designed warehouses in the UK. Its roots can be traced back to 1870 when British & Foreign Wharf was established in the Port of London to offer bonded warehouse services to the 19th century wine and spirit trade. Today LCB is the largest privately-owned bonded warehousing firm in the UK responsible for 7 million cases of wine in their 1.6 million square feet of warehouse space. It stores wine for most of the country’s biggest wine merchants and private clients from all over the world.

Wines stored with LCB are kept in a dedicated fine wine warehouse which boasts meter-thick walls and a state-of-the-art climate control system to avoid fluctuations in temperature and light. In accordance with ideal wine storage conditions, the average temperature is maintained at 13 degrees with 60-65% humidity and minimal exposure to light and movement. Often these bottles have been transferred directly from the producer’s cellar to the bonded warehouse and avoids unnecessary travel, giving them an ironclad provenance. The more a wine is transferred, the greater the opportunity for damage to happen to the bottles, cases or liquid. All of these factors contribute to the value of the wine. Another reason for storing our client’s wines in the UK is that London is the central hub for the global secondary market. Therefore, a large section of fine wine investors use the UK to store their wines.

Comprehensive INSURANCE coverage

To ensure comprehensive service to our clients, Oeno offers complete insurance coverage tailored to the unique characteristics of fine wine and whisky collecting from the moment the bottle leaves the vineyard or distillery during its transportation and its time spent in the secure bonded facility. By aligning ourselves with a specialist insurer, we guarantee insurance coverage of the product at total market value. This means that even if your bottles were to be broken or stolen after five years of being in storage, you would still be in a position to take advantage of the increase in market price. Furthermore, our insurance policy covers not only the wine and whisky itself but also any superficial damage to the packaging, such as stains on the labels or damage on the case, giving our clients complete confidence. If it’s damaged then it’s not in pristine condition when the time comes to sell. Oeno has structured the policy in such a way that provides the client with complete independence over their collection while we take care of the insurance details and all financial costs.

FAQs

Fine wine & whisky increase due to one fundamental reason: supply and demand. Like all luxury goods, if the demand outweighs the supply, the price of the goods increases. Both assets will evolve over time, in most cases the ageing of fine wine and whisky increases its flavour profile thus increasing its worth; this is true for whisky in the cask and fine wine in the bottle.

That usually depends on the collector; managed accounts can be opened for as little as £10,000. Our average client Portfolio tends to be between £25,000 – £50,000 and can rise to multi-million pound funds.

Even thought you are building a collection, like any asset, performance is not guaranteed, however, both wine and whisky have proven to be a safe haven in nearly all market conditions. With their low correlation to markets that effect economies, these sectors tends to be used as a hedging tool against riskier holdings. We have seen minimal effect to both markets over Covid, Brexit and the recent war with Russia. In fact, wine performed well over the Covid period with champagne showing a 79.7% over the two years of pandemic restrictions (2020/2021). There is always the risk of breakage or damage to stock whilst in transport or storage and, for this reason, all stock maintained by Oeno Group is insured at market price should the worst case happen. Our clients are fully covered.

Our business is to deal with a physical asset and, similar to selling a property, it can take time to liquidate. Oeno Group have gone further than any company in our field, allowing clients to exit direct to trade and direct to consumers, thus increasing the liquidity for our clients and speeding up the process. We recommend waiting for one of our exit platforms to request your asset for sale; this ensures that demand is sufficiently strong for that asset. However, when requesting for a sale please allow six months before needing funds in order to allow for a safe and efficient exit.

1. Please be aware that this is a long-term investment. We at Oeno Group strongly advise our private clients to expect a minimum hold period of 5 years for any wine held in their collections. If you have been advised otherwise, please contact your portfolio manager.

2. Fine wine & rare whiskey collections are physical assets. As such any sale is incumbent on a buyer being sourced ahead of time by Oeno Group. Should you wish to sell your wine ahead of an offer being prepared by Oeno Group, please be advised that a buyer may take time to source.

No, it is not. Currently, wine and whisky collecting does not come under the FCA regime.

Yes, our AWRS (Alcohol Wholesaler Registration Scheme) number is XKAW00000119972.