Trading Highlights

After a subdued Q2, momentum appears to be returning to segments of the fine wine market. Cristal 2013 has emerged as the top-traded wine of last week, with trade volumes rebounding sharply at around £1,600 per 12×75 – a price level last seen in 2021. This resurgence comes after a complete absence of activity for the label in June.

Spanish wines have also seen renewed attention, particularly Vega Sicilia’s Unico 2014, which secured the second spot on the week’s top-traded list. Spanish wines accounted for 10.2% of total market value traded – a notable increase for a category that had been largely quiet this year.

Deep Dive: Burgundy – Falling Prices, Rising Opportunity?

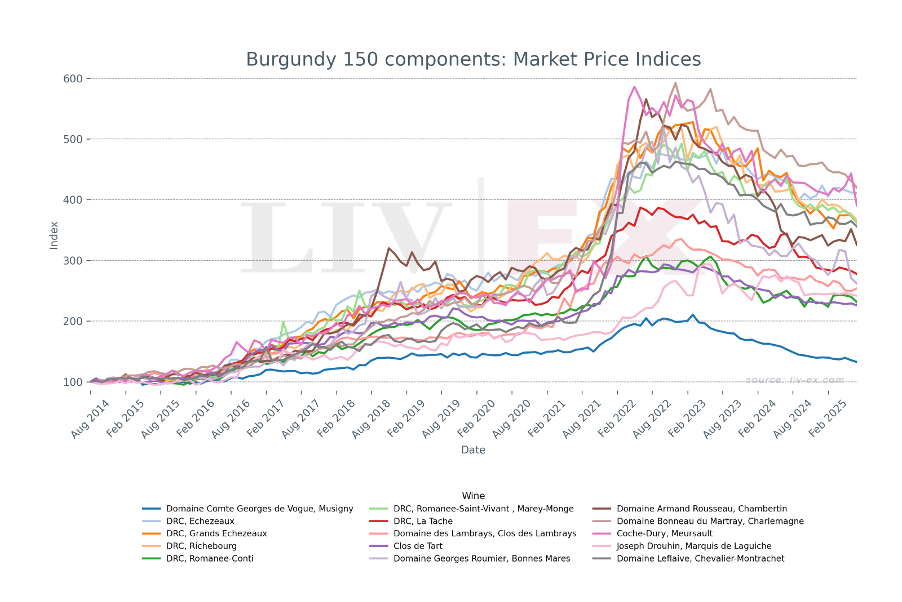

Burgundy’s correction continues, but new signs are emerging that the Burgundy 150 index may be finding a floor. After months of consecutive 1%+ declines, the index is showing technical and sentiment-based signs of stability:

- Bid:offer ratios are rising across both volume and value.

- Bid:offer spreads have narrowed, indicating that buyers and sellers are converging on price expectations.

- Mid-priced and lower-tier Burgundies have seen the most visible uptick in demand.

Among the Burgundy 150 components, several standout patterns and indicators suggest potential inflection points:

- Domaine de la Romanée-Conti: La Tâche, Romanée-Conti, and Echezeaux cuvées are now sitting flat on their long-term trend lines, with some recent upward movement in the latter two.

- Armand Rousseau Chambertin: The index has held steady at 2018 highs, suggesting technical support.

- Joseph Drouhin, Marquis de Laguiche: Trading within a descending wedge – a chart pattern often preceding breakouts – supported by rising volumes.

Quality vs. Price: Where Value Emerges

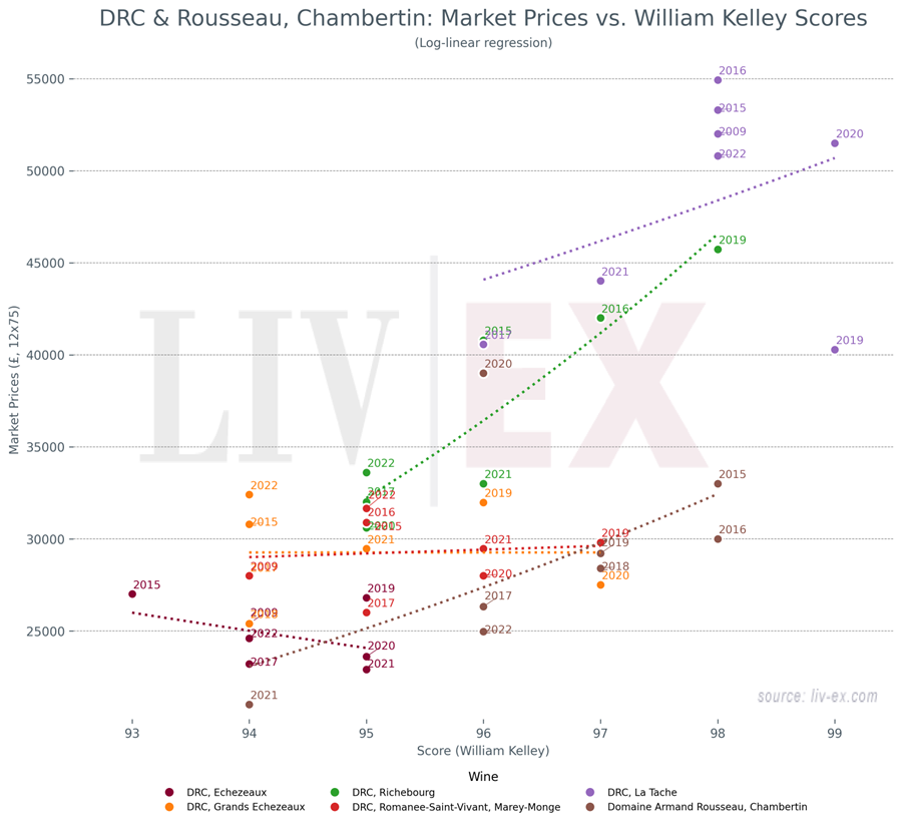

In a market where caution reigns and liquidity is selective, quality-to-price ratios are under the microscope. Running a regression between William Kelley’s Wine Advocate scores and current market prices reveals several value pockets.

- DRC Romanée-Conti was excluded from the analysis due to price skew. That said, the 98-point 2021 and 100-point 2020 vintages are trading at £162,000 and £189,000 respectively.

- Armand Rousseau Chambertin 2016 (98pts) stands out, now trading back at 2018 levels – a compelling proposition for investors seeking quality and historical support.

- Among the most affordable names in the Burgundy 150, Clos des Lambrays, Clos de Tart, and Bonneau du Martray appear undervalued relative to their critical scores.

One standout is Clos de Tart 2016, which received:

- 97 points from William Kelley,

- 99 points from Neal Martin (Vinous),

- and now benefits from almost a decade of bottle ageing.

This combination of quality, maturity, and value could make it a compelling acquisition for collectors and investors alike.

Final Thoughts

While the Burgundy 150 is not out of the woods, market dynamics are shifting. With sellers softening and buyers becoming more selective – and more score-driven – opportunities are beginning to emerge for those paying close attention.