Go beyond stocks and shares!

There IS another choice and it’s one you’ll kick yourself for not having made sooner.

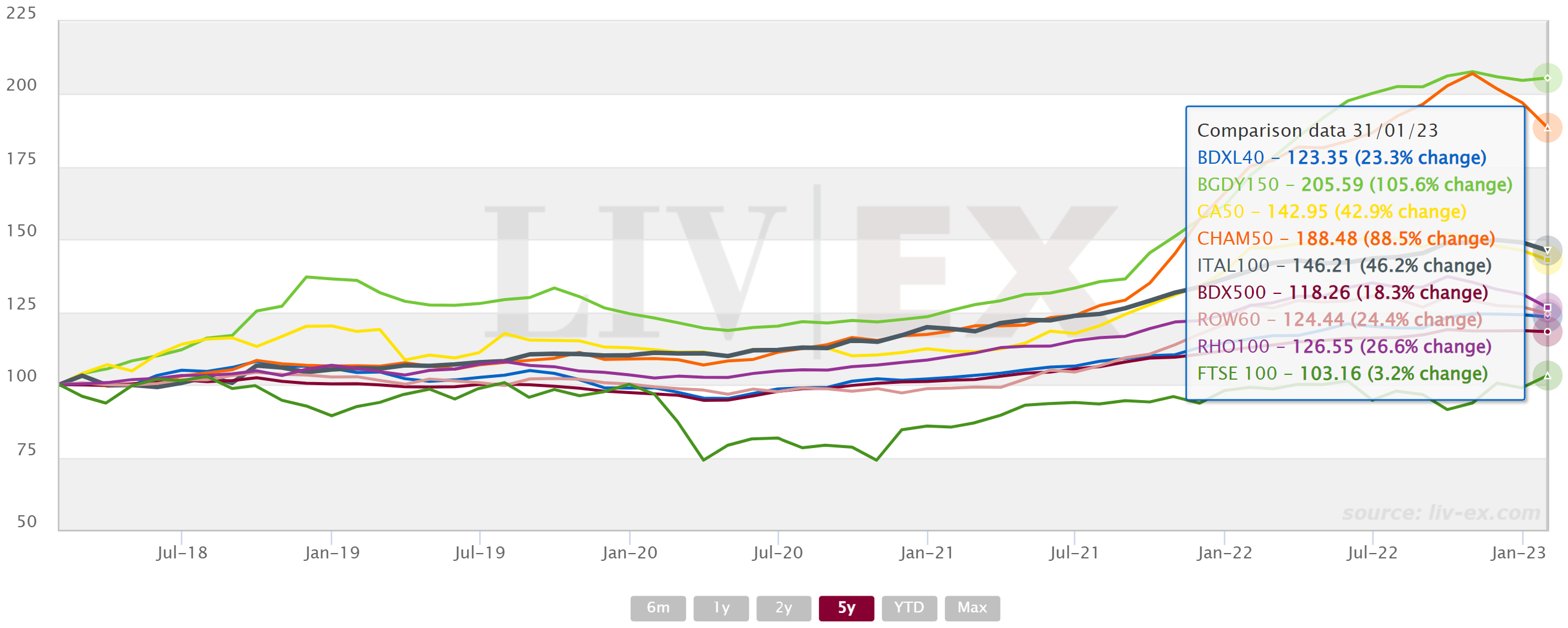

- Beaten the S&P 500 4.2X since 1952*

- Beaten the FTSE 100 174% since 2020*

- Top performing asset class last 5 years, up 147% over the past decade**

- Built-in inflation hedge, recession resistant***

- Personalized account management from start to finish

- Safe, secure, insured storage in London

- Low, efficient performance fees

*Forbes, Liv-ex 1000

** Annual returns of 10-15% are not atypical over long periods of time. Some rare bottles may do considerably better. For instance, wines from Domaine de la Romanée-Conti, arguably the world’s most prestigious winery, regularly show growth of 150-200% over a five-year period. Fine Wine assets have appreciated by 147% over the past decade. Liv-ex 1000, Knight Frank Luxury Index, OenoGroup

*** During the recession of 2007/8 the S&P 500 plunged 38.5%. In contrast, the Liv-ex 1000, the market-leading index for fine wine, dipped by just 0.6%. The same pattern emerged in March 2020 when the S&P 500 fell by 25% while the Liv-ex 1000 slipped barely 4%. Liv-ex 1000

Past performance does not guarantee future results.

Markets have never been more challenging.

- Deciding where to focus and why is overwhelming.

- Hedging against inflation and recession is essential but gold, crypto and other alternative assets haven’t performed as expected.

- Washington and Wall Street are out of control.

- It’s harder than ever to keep your money safe.

- Small minimums, no maximums.

- Absolute transparency

- Globally recognised

A simple, elegant solution.

Dependable RESULTS,

Consistently Returned

Panton Accountancy Services Limited can confirm that OenoFuture Limited has generated the following average returns on behalf of its clients over the years 2019, 2020, 2021 and 2022.

Client returns

Download your FREE

Investment Guide

Oeno has the good fortune to deal with some of the world's most exclusive clientele. That's why we take your privacy very seriously. Oeno will never sell, share, or disclose your information.

Why wine?

To be clear, when we talk about fine wine we’re not talking about the $9-bottle of mystery red you purchased last week at your local grocery store appreciating suddenly.

Investment grade wine is wine that’s inherently valuable from the get-go because it is produced in limited quantities by world recognized producers. There are fewer bottles every year which means that these wines will fetch higher and higher prices as they become increasingly scarce.

- Beaten the S&P 500 4.2X since 1952 – Forbes*

- Appreciated 147% over the past 10 years – Knight frank Luxury Index**

- Top performing asset class last 5 years – Liv-ex***

Why wine appreciates over time.

Rarity

Fine wines are made in very limited quantities, meaning that rarity can play a significant role in price performance. For example, a bottle of Armand Rousseau Gevrey Chambertin Clos St Jacques 2010 which increased by a remarkable 194.8% in just 11 months from January to November 2018.

Vintages

The quality of a particular vintage can heavily influence the price of wine. Typically, wines that take a longer time to mature will appreciate as the prime drinking window approaches.

Market Demand

The emerging middle and upper classes in countries like China and India have pushed demand through the roof. Worldwide demand is growing by triple digits according to Forbes, Nomisma Wine Monitor and other sources.

Some of our recent choices

Remoissenet Pere & Fils Clos de Vougeot Grand Cru

Year:

2014

Orig.price:

€1,020.00

Bought:

Mar 21

Sold:

May 24

Sale price:

€1,368.84

Gain:

34.19%

Dom Perignon Brut P2

Year:

2002

Orig.price:

£750.00

Bought:

Mar 21

Sold:

Jul 23

Sale price:

£978.00

Gain:

30.34%

Jean-Paul & Benoit Droin Chablis 1er Cru Vaillons 2018

Year:

2013

Orig.price:

$31.59

Bought:

Jun 20

Sold:

Sep 23

Sale price:

$40.33

Gain:

27.67%

Domaine Cecile Tremblay Morey Saint Denis Tres Girard

Year:

2012

Orig.price:

£821.20

Bought:

Aug 21

Sold:

Apr 24

Sale price:

£1524.87

Gain:

85.69%%

Benefits of wine investing

Price appreciation is not the only benefit to wine investing.

Moving a portion of your wealth into fine wine can be a smart move for other reasons.

Besides, you’ll sound cool when you talk to your friends.

Worldwide demand is growing

Inflation/recession resistant

Fine wine prices are a function of supply and demand. Every bottle consumed means higher prices for those that remain. Supply is truly limited because producers cannot make more of any given vintage because it is legally protected.

Low correlation

Research suggests that fine wine has a 0.03% correlation to the stock market. The wine market has survived every recession since 1929 and, in fact, has grown as an industry constantly over time.

Why whisky?

Whisky investment has garnered buzz for the high returns, exemption from capital gains and, of course, the chance to indulge in rare, sumptuous spirits.

Buyers looking to diversify their portfolio by acquiring whisky can do so in either cask or bottle format. Each offers unique advantages to buyers including significant profit margins as they age.

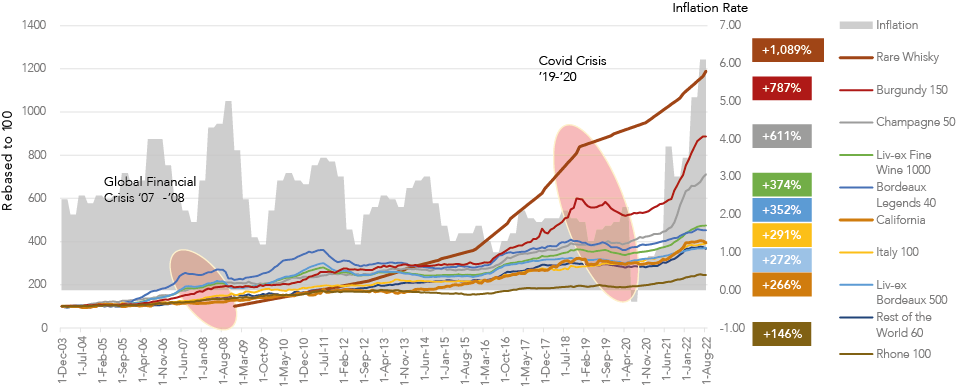

- Rare Whisky has been the top performer (+1,089% since Dec’08), followed by Burgundy 150 (+787% since Dec’03) and Champagne 50 (+611% since Dec’03)*

Where OENO comes in

Our goal is to make fine wine and whiskey investing accessible to all. We do that by sourcing the world’s highest scoring, best-rated wines in under-the-radar fine wine regions and revolutionising the way collectors interact with this unique market.

OenoFuture provides a personalised advisory service for both newcomers and experienced fine wine collectors.

Clients can choose to rely on our expertise to guide them all the way or, alternatively, take a more active role in their fine wine journey with exclusive tasting events and winery tours.

How it works

You can be as hands off or as hands on as you like.

We want to make your relationship with Oeno an amazing experience at every level.

We will keep things simple and transparent at all times.

Step 1

Step 2

After you have spoken with your account manager, received your information and agreed on which wines you’d like to buy, you will receive your contract via email . This will need to be signed electronically and sent back to Oeno.

Step 3

Once your wine has reached a financial peak, Oeno will seek buyers through distribution channels including some of the world’s finest restaurants, hotels, wine bars or private collectors. You can collect the proceeds or reinvest to begin the process again.