The week’s top-traded wines by value were Opus One 2021, Petrus 2017, and Dom Pérignon 2012.

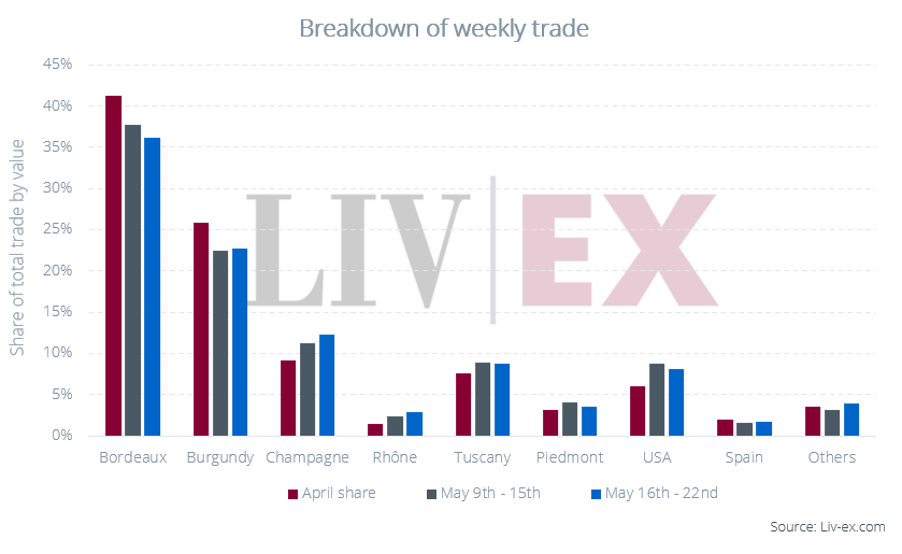

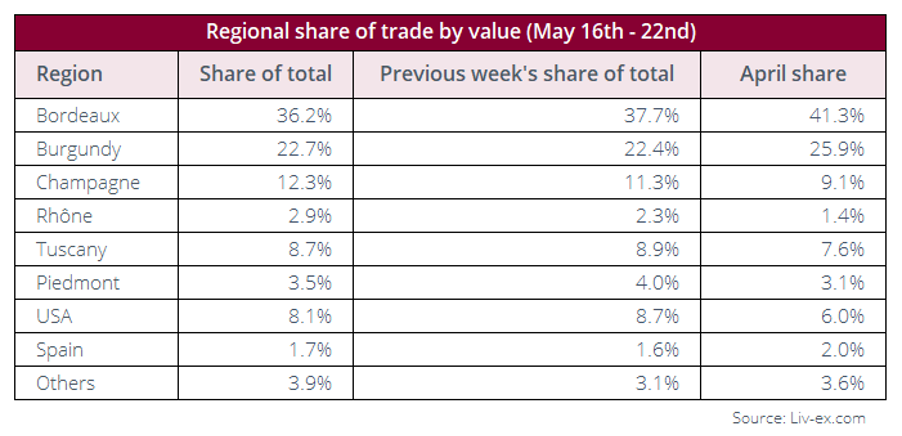

Bordeaux remained firmly in the lead with 36.2% of traded value, down from 37.7% last week. Petrus dominated the region’s performance, accounting for nearly a fifth of Bordeaux’s traded value. By volume, Pichon Longueville Comtesse de Lalande took top spot, and by frequency, it was Vieux Château Certan.

Burgundy maintained its second-place position with 22.7% of traded value. Notably, Domaine Ponsot joined Burgundy’s trading elite alongside Domaine de la Romanée-Conti and Domaine Bonneau du Martray, thanks to higher volume trades.

Champagne saw an increase in share, up from 11.3% last week to 12.3%. Dom Pérignon 2012 and Ruinart Brut NV led the region by volume, while Salon 2006 continued its steady run.

Both Tuscany and Piedmont saw slight declines in market share. Nonetheless, flagship names like Tignanello, Sassicaia, Bruno Giacosa, and Giacomo Conterno remained active.

In the US, the trade share dipped to 8.1%, though still well above its April low of 6.0%. Opus One dominated, accounting for over half of the US’s traded value across vintages.

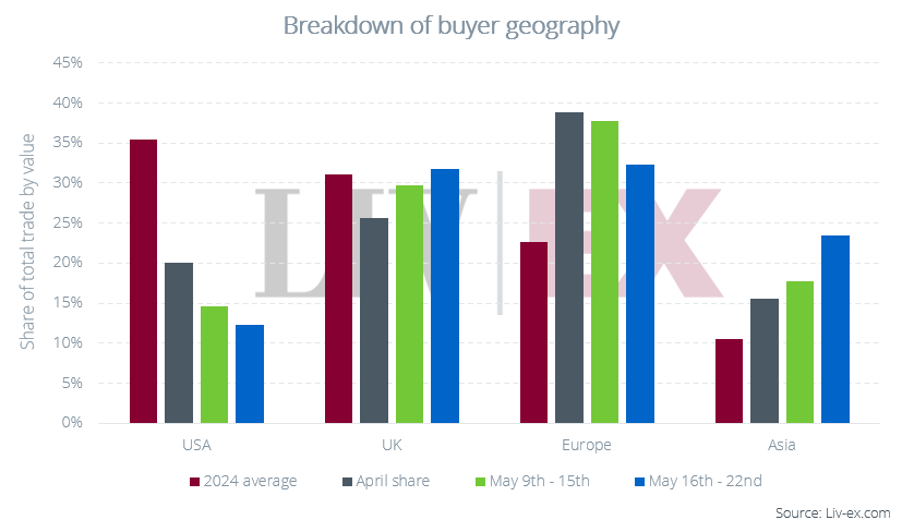

Breakdown of buyer geography

US buying fell to a 12.3% share from 14.6% last week, with most activity in Burgundy, Bordeaux, and Tuscany (around 20% each). They remained particularly active in Brunello, accounting for 69.3% of purchases.

Asian buyers’ share rose to 23.4% as they continued to shy away from En Primeur but remained active in back-vintage Bordeaux. Petrus, Vieux Château Certan, and Haut-Brion were the top-traded names in this segment.

What were the week’s top traded wines?

Opus One 2021 was last week’s top-traded wine by value, having finished in second place the week before last. The week’s trades took place at a slightly lower price point than the prior week.

Petrus 2017 came in second place. While cases of 12 traded flat on their 2020 prices, single bottles (in OWC) garnered a hefty 26.8% premium.