Signs of Resilience and Growth

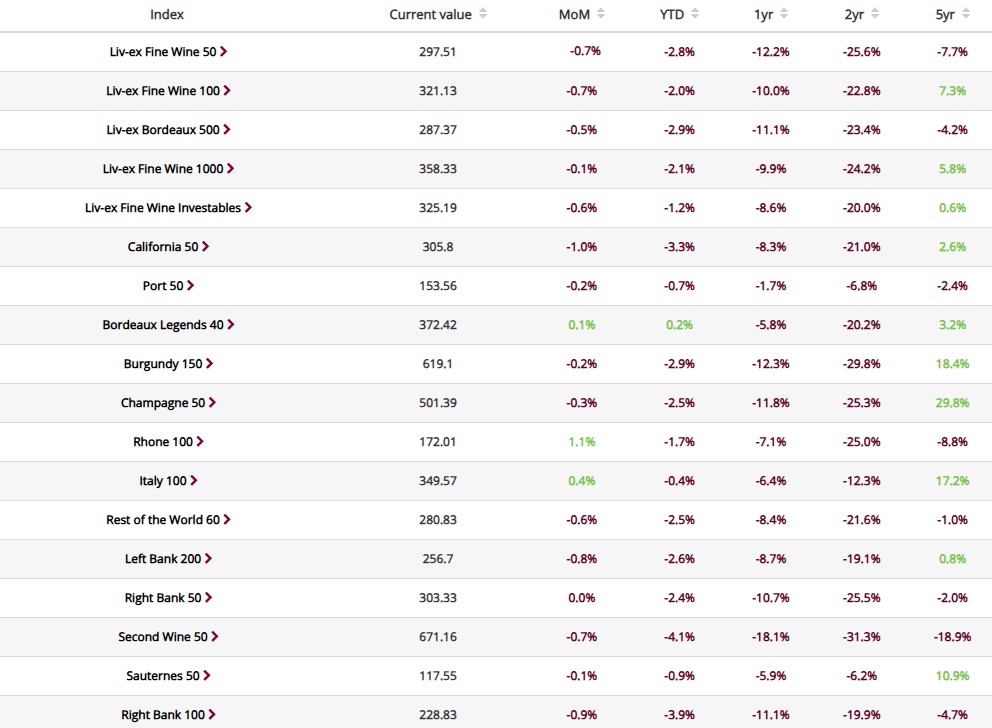

Despite recent challenges, there are encouraging signals in the fine wine market, suggesting brighter prospects for collectors and investors. In March, the Liv-ex Fine Wine 100—the industry’s benchmark index—registered a modest decline of 0.7%, closing at 321. However, this slight dip was accompanied by strong individual performances: Domaine Trapet Père et Fils Chambertin 2020 and Bartolo Mascarello Barolo 2019 gained 12.5% and 8.5% respectively, showing that top-quality wines continue to draw robust interest.

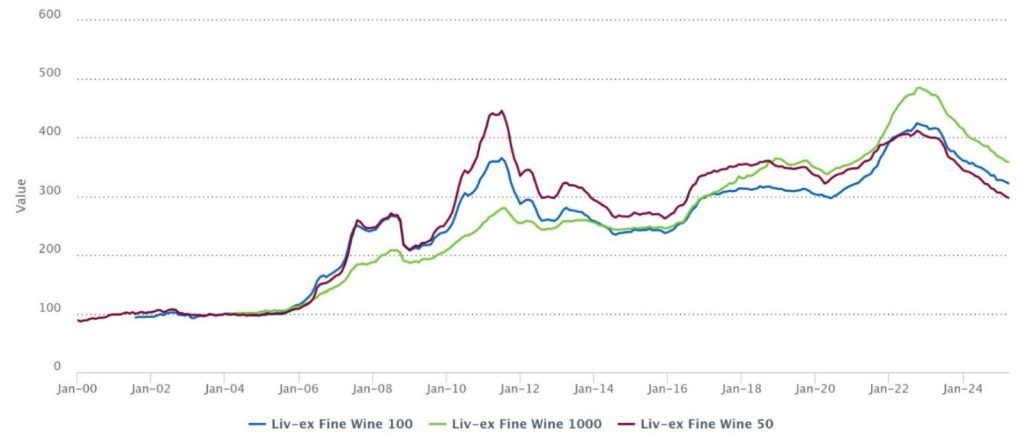

Fine Wine 1000: Stability and Opportunity

Looking at the broader market, the Liv-ex Fine Wine 1000 dipped just 0.1% in March. Notably, Château Suduiraut 2021 soared 27.2%, benefiting from a combination of exceptional quality and limited yields. Sauternes producers, in particular, have shown that even in a challenging vintage, there’s room for remarkable price performance. This suggests that discerning buyers can still uncover strong investment opportunities within niche segments of the market.

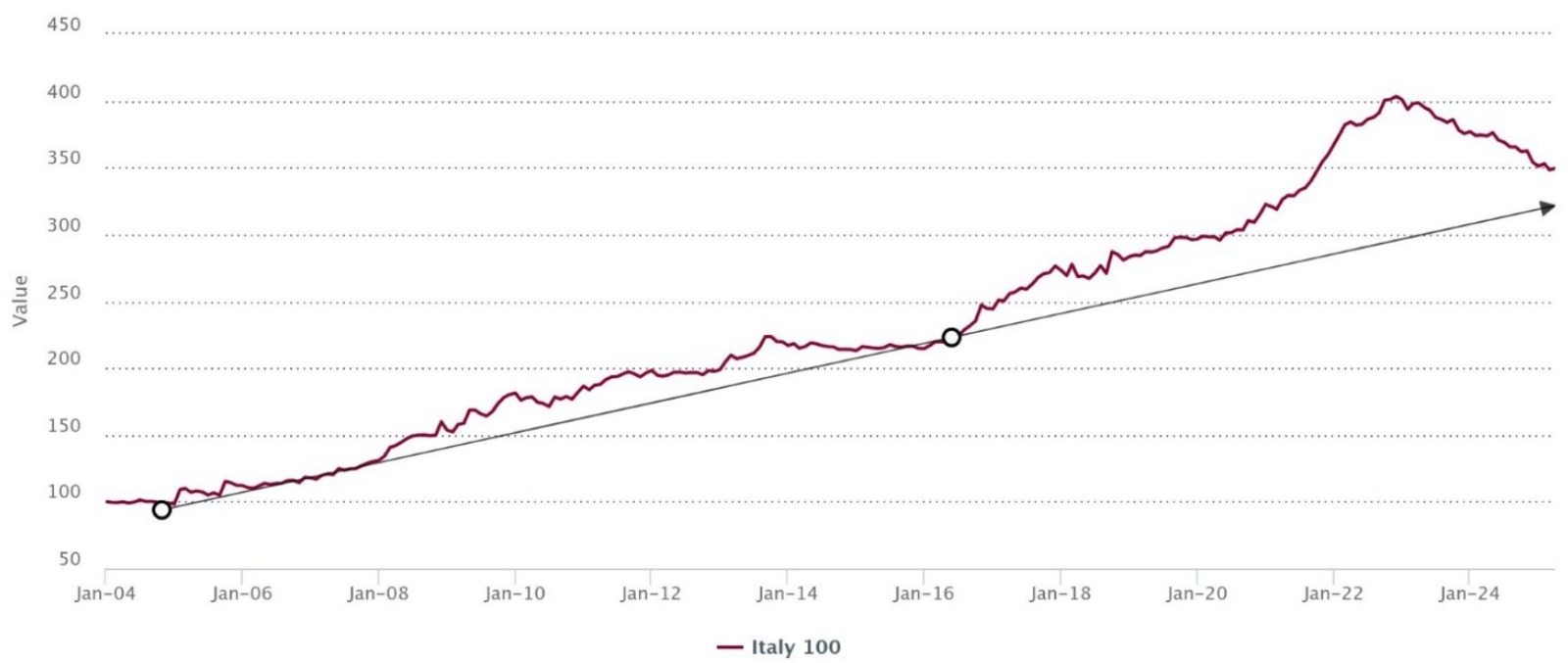

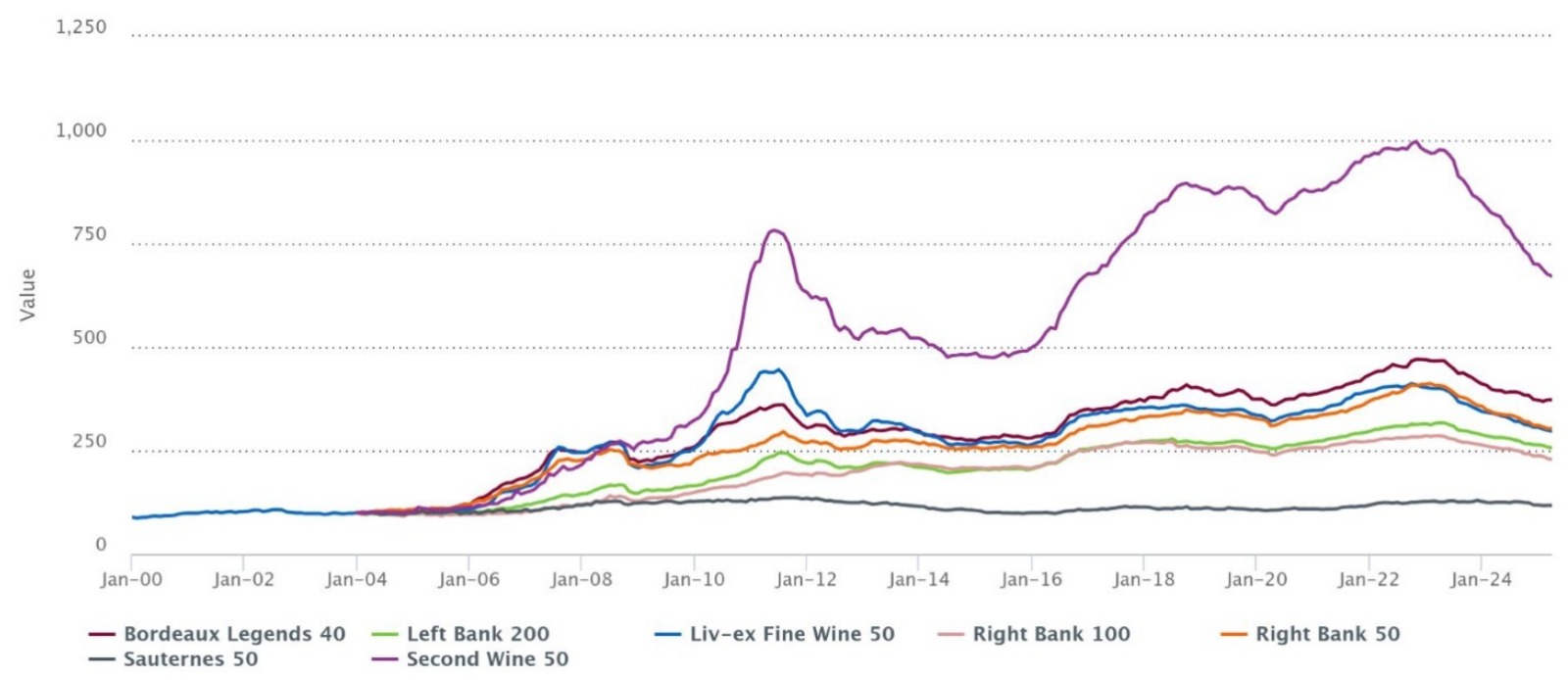

A Closer Look at Regional Indices

The Rhône 100 emerged as the top-performing regional index, up 1.1% in March. While historically more volatile, its recent gains point to renewed confidence in the Rhône. Meanwhile, the Italy 100 continued its steady ascent with a 0.4% increase, proving that this region remains a source of stability and long-term value. In Bordeaux, the Bordeaux Legends 40 eked out a 0.1% gain, contrasting with minor corrections seen in younger vintages, which are undergoing healthy price adjustments that set the stage for future growth.

Bordeaux: Signs of Support and Recovery

The Bordeaux 500 index slipped by 0.5% in March, but within this broader trend, key wines are finding solid ground. For example, Cheval Blanc 2016 rose by 6.7%, bouncing off key technical support levels. This kind of upward movement indicates that well-established wines are starting to regain traction. Other noteworthy Bordeaux 500 components – including Cheval Blanc 2019, Château Pichon Baron 2013, Château Duhart-Milon 2012, and Château Lafleur 2015 – are also stabilising, suggesting a potential turning point.

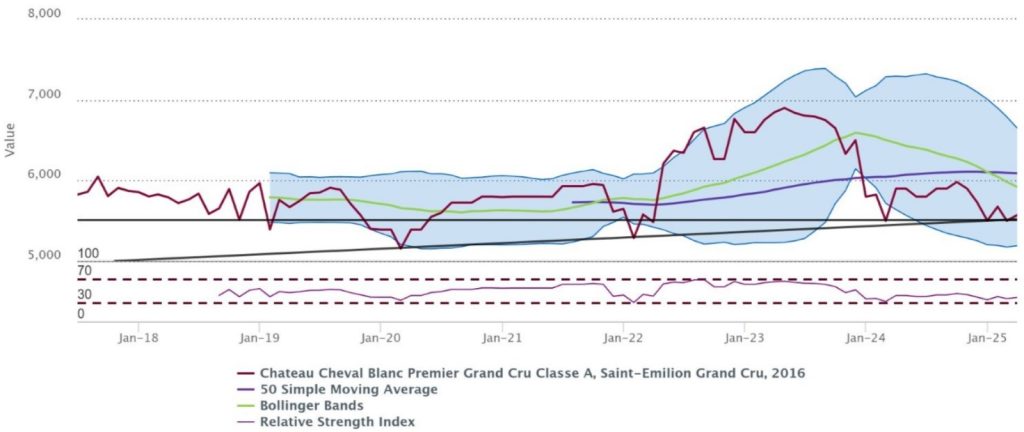

Technical analysis of Cheval Blanc 2016

Technical analysis presents a promising outlook for Cheval Blanc 2016. Its Market Price has recently bounced twice at the convergence of its horizontal support (2024 low) and long-term trendline, forming a double bottom pattern. Moreover, a weak bullish divergence has arisen between its price and Relative Strength index (a slightly lower low for the index and a higher low for the RSI in February this year). Paired with decreasing volatility, as indicated by the narrowing Bollinger Bands, a breakout now appears likely. Historically, bullish divergences (as seen in March 2020 and March 2022) have been precursors to upward price movement for Cheval 2016.

Cheval ‘16 is not alone here. There are several Bordeaux 500 wines with prices reaching (and sustaining at / bouncing from) key support levels. Technically inclined readers may also take interest in Cheval Blanc 2019, Château Pichon Baron 2013, Château Duhart-Milon 2012, Château Lafleur 2015.

A Positive Outlook

While the market as a whole has faced pressure in recent years, these March figures highlight areas of resilience and potential recovery. The fine wine market’s ability to weather challenges and deliver standout performances from iconic producers offers hope that upward trends are on the horizon. As the market finds its footing, now may be an opportune time for collectors to focus on high-quality wines that have demonstrated enduring strength.