As summer heatwaves intensified and global tensions continued to ripple through economies, this week offered a striking blend of high-stakes diplomacy, domestic policy shifts, and cultural milestones.

United Kingdom

Prime Minister Sir Keir Starmer made headlines this week with a landmark migration agreement alongside French President Emmanuel Macron. The new “one-in, one-out” arrangement aims to return up to 50 Channel-crossing migrants per week to France, in exchange for Britain accepting 50 vetted asylum seekers. Billed as a strategy to disrupt smuggling networks, the plan faces complex legal and operational challenges before it can be fully rolled out.

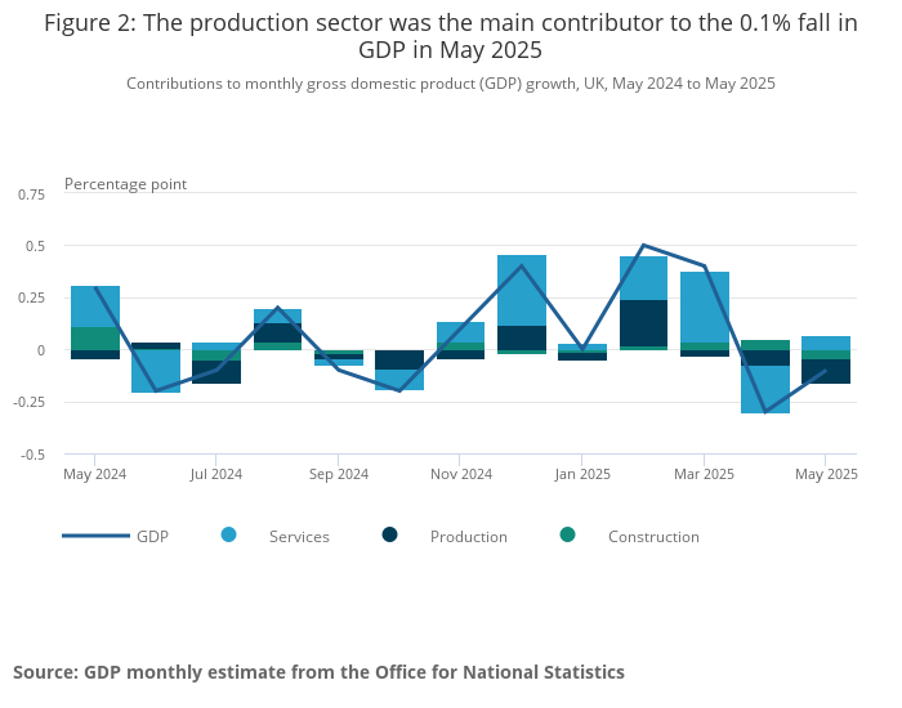

At home, Britain’s economy unexpectedly shrank in May, fuelled by sharp declines in manufacturing and construction, in a blow for the chancellor, Rachel Reeves, amid speculation over tax increases. The Office for National Statistics said gross domestic product fell by 0.1% in May, missing City predictions of a 0.1% monthly expansion. It was the second month of contraction in a row after a 0.3% drop in April as businesses cut jobs and cancelled investment plans in response to higher taxes and uncertainty created by Donald Trump’s tariff war. The latest figures show declines in construction, oil and gas extraction, car manufacturing and the production of pharmaceuticals outweighed a return to growth in Britain’s dominant service sector, amid a slump in activity after a strong first quarter.

In further bad news for the government, Labour unveiled plans to relax biodiversity net gain requirements for small developers – a decision that sparked outcry among environmental groups. Critics warn it could put over 215,000 hectares of natural habitats at risk, equivalent to the size of the Yorkshire Dales.

The UK also marked 20 years since the 7/7 London bombings, with Prince William joining survivors and bereaved families at a moving memorial in Hyde Park and a service at St Paul’s Cathedral. Meanwhile, wildfires continued to spread across the country, with major incidents reported in Sedgley, barley fields, and heathlands – making this the most destructive wildfire season on record.

In Parliament, debates ranged from welfare reform to football governance, while internal party dynamics shifted dramatically: Zarah Sultana announced her departure from Labour to form a new party with Jeremy Corbyn, and former Conservative MP David Jones joined Reform UK. The long-awaited final report into the Post Office Horizon scandal was also released, condemning the catastrophic handling that led to hundreds of wrongful prosecutions.

On the cultural front, Oasis kicked off their first tour in 16 years to fervent fanfare, and Black Sabbath played a historic final concert that raised £140 million for charity.

United States

In Washington, President Trump continued his assertive economic agenda, threatening to impose an extra 10% tariff on imports from BRICS-aligned nations if no deal is reached by the 9th of July (which has clearly now passed). Brazil is now facing a 50% tariff on all exports to the US. Trade Secretary, Howard Lutnick, reigned back a little and said the tariffs will now start on the 1st of August. Commentators are mentioning that the cause of Trump’s ire towards the BRICS nations is that there are reports of them discussing an alternative reserve currency. In 2024, Trump threatened 100% tariffs on BRICS countries if they moved ahead with their own currency to rival the US dollar.

The move also underscores escalating trade tensions and is widely viewed as an attempt to bolster US manufacturing and domestic jobs ahead of the 2026 midterms. Simultaneous negotiations with the EU over car and steel tariffs remained deadlocked, leaving transatlantic trade relations on shaky ground.

Domestically, Trump signed a sweeping tax and spending bill that includes $1 trillion in cuts to Medicaid, food aid, and social programs, alongside increased funding for deportations. Economists warn the bill could add $3.3 trillion to the federal debt by 2034, igniting fierce debate over fiscal priorities and social welfare.

Adding to the week’s turmoil, catastrophic floods devastated central Texas, killing at least 82 people – including several children attending summer camps – and leaving dozens missing. The disaster is expected to inflict heavy economic damage on local infrastructure and agricultural production, further straining regional recovery efforts.

Despite this, the Nasdaq and S&P 500 both recorded new all-time highs. Some in the markets are now debating the validity of these upward moves as tariffs

European Union

Across the Channel, President Macron’s state visit to the UK aimed to strengthen ties after years of post-Brexit tension. The two leaders announced deepened cooperation on nuclear energy and migration, alongside cultural initiatives, including a symbolic proposal to loan the Bayeux Tapestry to Britain.

However, back home, France faced its own crises. A deadly heatwave swept across the country, claiming multiple lives – including that of an American tourist visiting Versailles – and fuelling widespread public health concerns. Simultaneously, air-traffic controller strikes disrupted travel across Europe, highlighting simmering tensions in essential public services just weeks ahead of the Paris Olympics.

Despite these domestic pressures, European markets remained relatively stable in the face of Trump’s tariff threats. Germany’s manufacturing sector showed tentative signs of recovery after months of stagnation, while a surprise dip in French inflation fuelled speculation that the European Central Bank may soon consider easing monetary policy.

China

China’s week was dominated by stalled trade negotiations with the United States. Beijing firmly rejected US demands related to strategic mineral access and semiconductor supply chains, pushing the two nations closer to a renewed trade standoff. The uncertainty rattled investors globally and reignited fears of supply chain disruptions.

On the economic front, China reported steady year-on-year export growth in June, driven largely by higher shipments to ASEAN nations and Africa. However, weaker domestic consumer spending and rising youth unemployment – now above 20% – continue to underline the fragility of China’s post-pandemic recovery.

Meanwhile, Beijing intensified its efforts to build influence through the BRICS alliance, promoting deeper economic and security ties among emerging markets. This positioning reflects China’s strategic push to lead a counterbalance to Western-led economic coalitions.

Gold & Metals

Amid global uncertainty and trade tensions, gold prices continued their upward trajectory, hitting a high of $3,359.60 per ounce this week – their highest level since May. Investors sought refuge as Trump’s tariff threats loomed, and geopolitical risks mounted.

Silver also gained, climbing past $38 per ounce today, buoyed by both safe-haven demand and strong industrial buying linked to green energy applications. Platinum prices edged higher as well, supported by rebounding automotive catalyst demand in Europe and tighter supply from South Africa.

Copper markets saw renewed volatility. While prices initially dipped due to weak Chinese consumer data, they rebounded on reports of supply disruptions in Chile and Peru, as well as renewed optimism around European manufacturing data.

Overall, the metals sector underscored investor nervousness around inflation, trade policy, and the global energy transition – reinforcing its status as both a hedge and a barometer for industrial health.

Key Takeaways

- Migration & security: The UK and France’s new migrant pact marks a significant diplomatic shift, though implementation challenges lie ahead.

- Economic nationalism: President Trump’s tariff brinkmanship and domestic cuts illustrate America’s inward turn, with ripple effects across global trade.

- Climate emergencies: Extreme weather from Texas to Europe underscores the mounting cost of climate inaction on human and economic systems.

- China’s assertiveness: China’s hardening trade stance and strategic pivot to BRICS deepen the global east–west economic divide.

- Safe havens surge: Rising gold and metals prices reflect a flight to safety amid geopolitical and inflationary fears.

- Cultural milestones: The Oasis reunion and Black Sabbath farewell highlight a defining moment for British music on the global stage.