What’s happening in the market?

Château Lafite Rothschild 2020 led last week’s activity, trading in healthy volumes at £3,920 per 12×75. That represents a 33.3% discount to its ex-London release price of £5,880 – a stark reminder of how pricing during the 2020 En Primeur campaign still hangs heavy on the secondary market.

Cristal 2016 has taken the second spot, while Domaine de la Romanée-Conti’s La Tâche 2015 rounds out the top three. Together, these names highlight how activity is clustered at the very top end of Bordeaux, Champagne, and Burgundy.

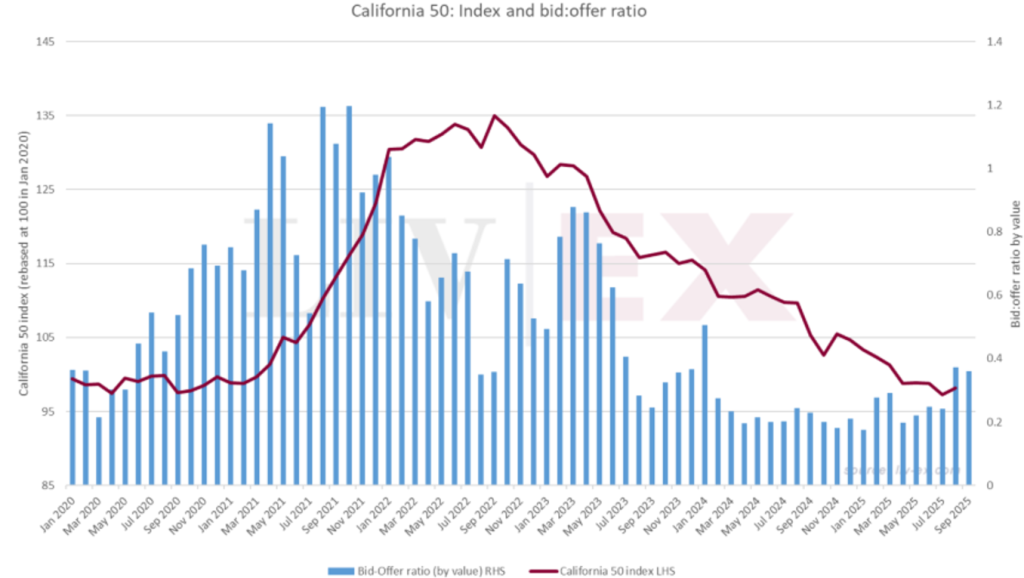

Today’s deep dive: California 50’s bid:offer ratio on the rise

In August, the California 50’s bid:offer ratio by value jumped to 0.37 – its strongest reading since January 2023. While it has edged back slightly to 0.36, this remains a clear improvement on its average of just 0.22 between February 2024 and July 2025.

Why does this matter?

The bid:offer ratio is widely regarded as a leading indicator of market confidence and future price movements. Historically, a reading above 0.3 in the California 50 has been followed by periods of stability or recovery – as seen in 2020 and late 2023.

This latest rise comes just as the index returns to its 2020 lows, a key support zone. Should buyers continue to step in at these levels, the California 50 could find a firmer footing over the coming months.

Digging into the detail

While the uptick in bids is encouraging, overall trade volumes remain muted compared with Q1. A healthy bid:offer ratio signals confidence, but without liquidity, price recoveries are less reliable. As noted before on Californian investment opportunities, risk-averse buyers should focus not just on ratios but also on which wines are actually trading.

Opportunities: high bid:offer ratios and recent trade

Opus One stands out on both counts. It currently has the highest bid:offer ratio in the California 50 (0.58, up from 0.33 in August) and is also the most actively traded. Recent trades in the 2012 and 2013 vintages have cleared above their previous levels, while the 2018 changed hands above its Market Price. This suggests that at least some corners of the index are beginning to attract real momentum.

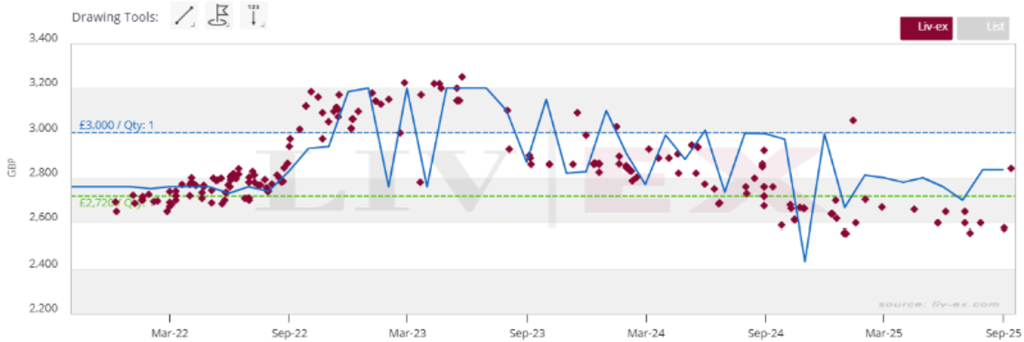

Liv-ex trades of Opus One 2013:

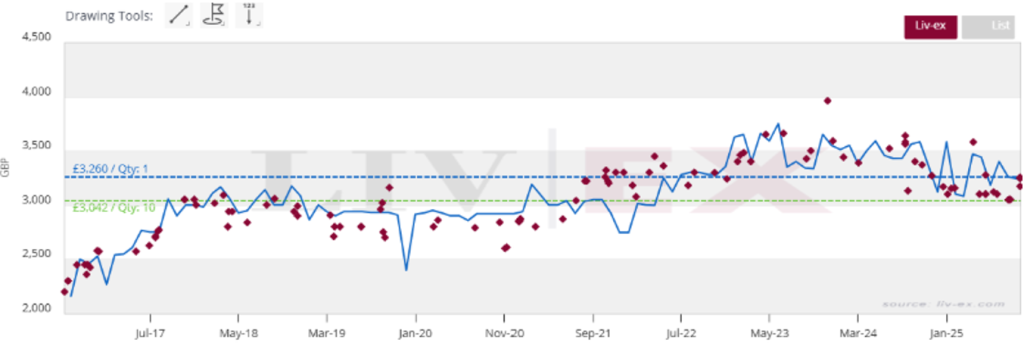

Liv-ex trades of Opus One 2012:

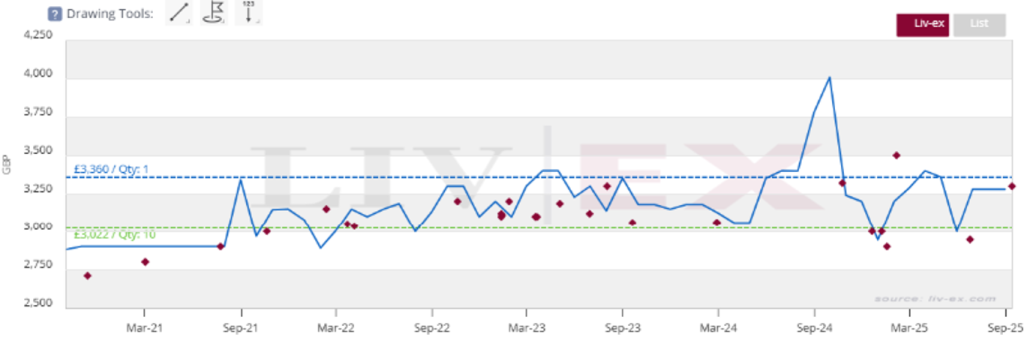

Liv-ex trades of Opus One 2018: