It’s that time of year again when the largest and most liquid market for fine wine in the world gives us a chance to buy grand cru classé wines before they’re bottled at a lower price.

It’s an opportunity for merchants and private buyers around the world to see which vineyards have the most promise and which bottles have the best appreciation potential.

We’re talking about Bordeaux en primeur, of course. Over the past half-century, Bordeaux’s en primeur system has radically reshaped the wine industry’s economic landscape.

Originally born in the 18th Century as a means to provide cash flow to struggling Châteaux, during the post-WWII era, it was championed by Bordeaux’s leading merchants, such as Ginestet, Calvet, Cruse, and Cordier, among others.

For almost 200 years, it was more about securing funds and volumes than emphasising quality, but this changed in the 1970s when the Bordeaux wine scene began to catch the world’s attention, sparking interest and expanding its market reach, allowing merchants to snap up large amounts of wine from the best vineyards in the world

today, en primeur remains a vital conduit for securing sought-after wines before their official release.

The pivotal 1982 vintage marked a turning point, attracting American buyers and solidifying en primeur’s role as a savvy investment opportunity supported by the strong dollar. The 1980s also witnessed the influential rise of Robert Parker’s 100-point scoring system, which opened up Bordeaux wines to a growing number of younger international collectors.

Over the following decades, the system thrived, offering private individuals access to Bordeaux wines at favourable prices while enabling Châteaux to invest in quality equipment and planting vineyards. Today, en primeur remains a vital conduit for securing sought-after wines before their official release, sustaining Bordeaux’s reputation as a global wine powerhouse amidst evolving market dynamics.

WHY BORDEAUX?

The history of Bordeaux wine stretches back nearly 2,000 years to Roman times when the initial vineyards were established here. These exceptional wines often outperform traditional assets like art and bonds with impressive price appreciations.

In 2021, despite turbulent markets, Bordeaux prices surged by 13.2%, as seen on the Liv-ex Bordeaux 500 index, with standout performers like Château Rieussec Premier Cru Classé Sauternes 2011 witnessing a remarkable 52% increase in value over just twelve months.

Furthermore, Bordeaux wines consistently achieve stellar results at auction, such as a bottle of 1869 Château Lafite Rothschild fetching a record $232,682, making it the most expensive 750ml bottle of wine ever sold at the time.

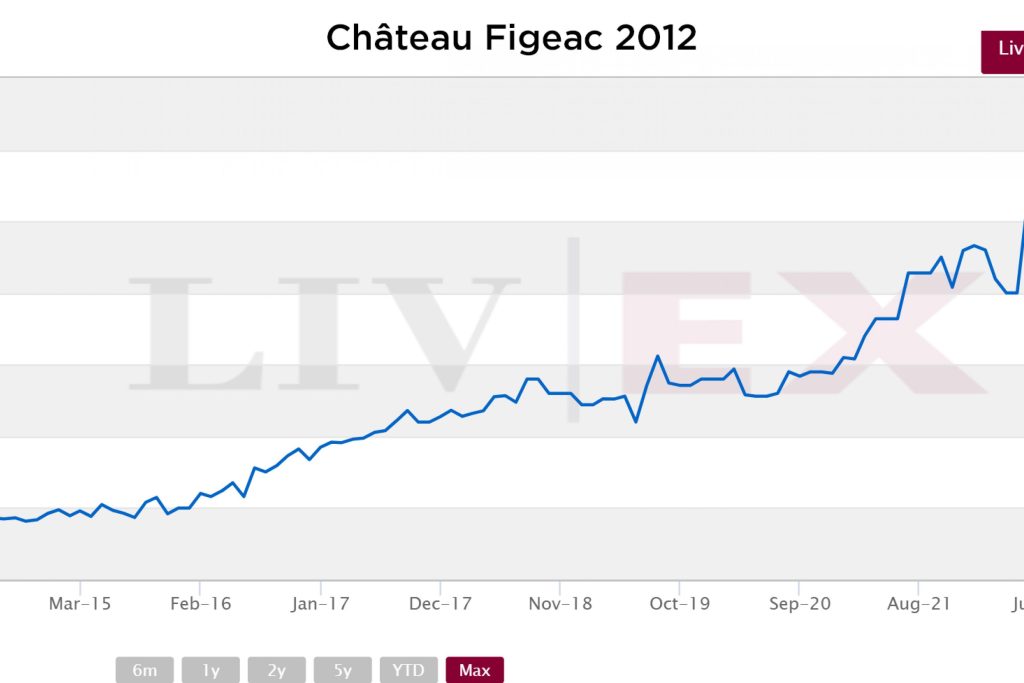

In terms of en primeur vintage returns, Château Figeac 2012 has seen its average market price soar by 217% over the last decade, while the 2011 saw a significant increase of 130%. Similarly, Château Angelus 2012 and 2011 vintages have enjoyed increases of 117% and 111%, respectively. Both wines have garnered high praise from renowned critics, with Jane Anson giving Angelus 2012 an impressive 97/100 points and James Suckling rating Figeac 2012 at 94/100 points. Additionally, Lisa Perotti-Brown awarded Angelus 2011 a 95/100, and James Suckling gave Figeac 2011 a 94/100.

FTSE Since 2011

Whilst you may feel you’ve missed out on these returns, Oeno Group’s access to the fine wine market means that you haven’t missed out entirely. Now available are the exceptional 2021 and 2022 vintages of Angelus and Figeac, among others. These wines have earned remarkable accolades from esteemed wine critics: Angelus 2021 received a 95/100 rating from Jane Anson, and Angelus 2022 was awarded a perfect 100/100 by Chris Kissack. Similarly, Figeac 2021 scored a 97/100 from Jane Anson, while Figeac 2022 achieved another perfect 100/100 from Chris Kissack.

With such impressive critic scores, these vintages are poised to outperform even the returns produced by their 2011 and 2012 vintages, offering significant potential for appreciation over the next ten years.

Oeno is releasing its Bordeaux campaign with an excellent selection of 2021 and 2022 wines. See oenogroup.com/en-primeur

As Seen In https://squaremile.com/investment/wine/bordeaux-en-primeur/