Roman vineyards established

Bordeaux under English control

Bordeaux wine trade privileges

Médoc drained by Dutch

1855 Classification

Modern Bordeaux revival

It isn’t hyperbole to say that Bordeaux has one of the richest and most storied histories in the world of wine. As far back as AD 60, records show that the Romans brought vines to the town then known as Burdigala, introducing both viticulture and winemaking expertise to the region.

Bordeaux’s next major growth, in 1152, came through the marriage of Eleanor of Aquitaine to Henry Plantagenet – later to be known as King Henry II. This marriage brought the region under English control and regular transportation was seen from the port of Bordeaux to England, increasing the popularity of the region outside of France. In the 13th & 14th centuries, the “Grand Coutume” tax exemption & trade privileges for the region meant that Bordeaux dominated other regions such as Burgundy in the export market, further enhancing its international reputation.

Then the great Dutch engineers came to the Médoc in the 17th & 18th centuries to drain what was then swampy land into prime vineyard territories. The great Châteaux of today, such as Margaux, Lafite & Latour rose from the Médoc to dominate the region (and global wine). This was enhanced in 1855 with the ‘Classification.’ For the Exposition Universelle de Paris, Emperor Napoleon III ordered the region to rank the best Médoc & Sauternes wines into a tiered system based on reputation and trading prices. This exists to this day and gives us the famous ‘Growth’ system (1-5 on the Left-Bank and 1-3 in Sauternes & Barsac)

Given its long history, it is certainly not wrong to say that holding investment grade Bordeaux wines is a long-term play. To highlight this, the recent announcement from Château Batailley about the 2024 vintage release price showcases this quite well.

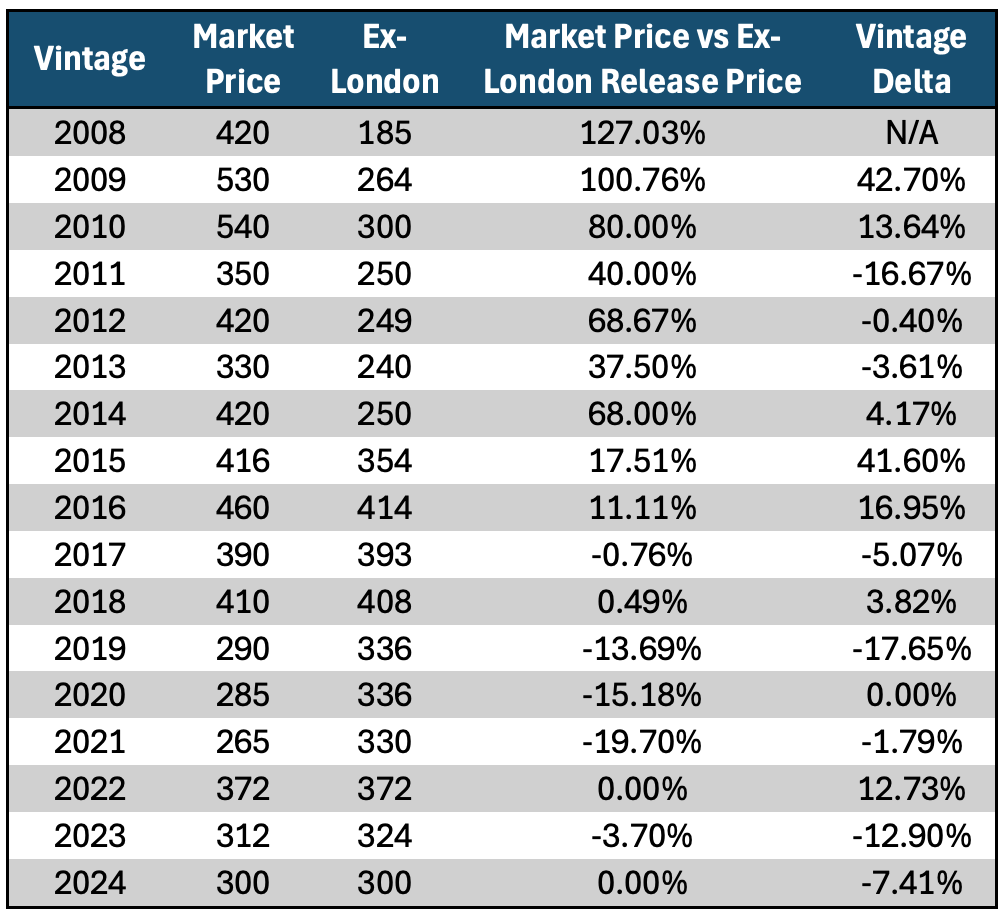

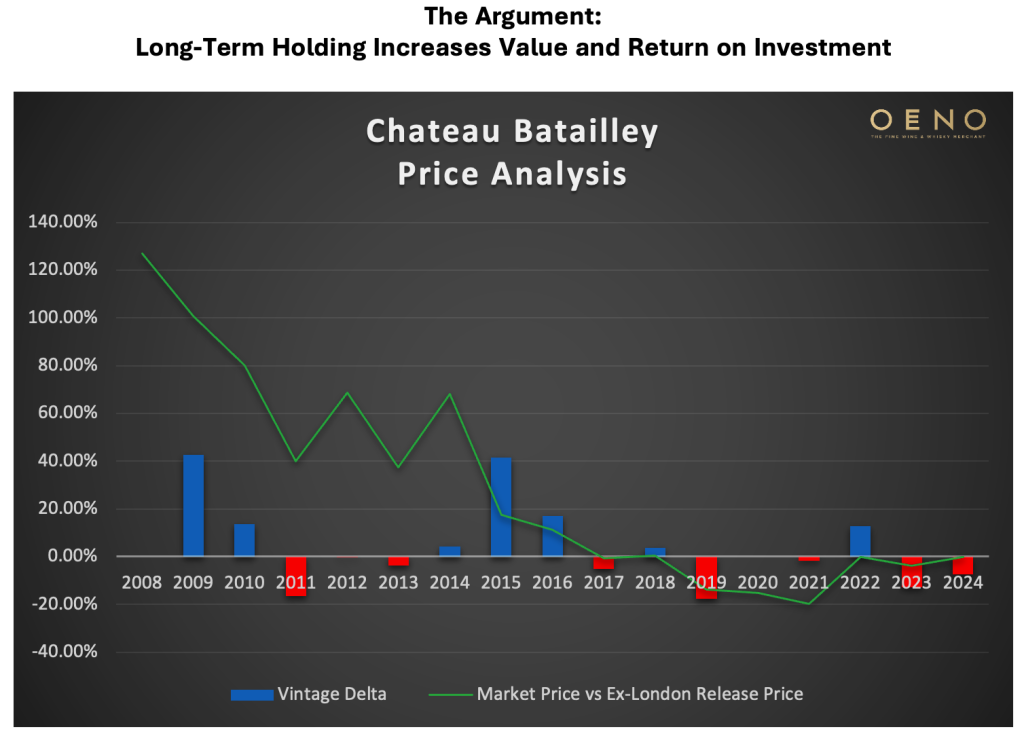

The table above represents data released by Liv-ex, detailing the recent release history from the château, starting with the 2008 vintage. This period is particularly insightful, as it includes celebrated vintages such as 2009, 2010, and 2015, offering a clear view of how release prices have evolved around these key benchmarks. It also captures price dynamics through significant market events, including the COVID-19 pandemic.

I have added in two columns:

- Market Price vs Ex-London Release Price: a comparison of the Liv-ex price today vs where the vintage was released on the London market

- Vintage Delta: This is the change in Ex-London release price year-on-year from 2008 to 2024 vintages

1. Substantial Price Appreciation Over Time

The pricing table clearly illustrates that older vintages of Château Batailley have experienced significant price appreciation compared to their original release prices (Ex-London). For example:

- The 2008 vintage shows a Market Price of £420 compared to an Ex-London price of £185, marking a 127% increase

- The 2009 vintage rose from £264 (Ex-London) to £530 (Market Price), reflecting a 100.8% gain

- The 2010 vintage climbed from £300 (Ex-London) to £540, achieving an 80% increase – however with this vintage it is also interesting to note that the substantial vintage delta to the 2009 vintage has eaten into the growth achieved

2. Consistent Vintage Delta Reflects Price Growth

The “vintage delta,” or the year-over-year increase in ex-London prices, further supports long-term holding. These deltas indicate that wines often re-enter the market at higher valuations, reaffirming their investment potential. Wines such as the 2012 and 2014 vintages demonstrate dramatic uplifts. These are both viewed as “off-vintages” but still offer significant gains:

- 2012 increased from £249 to £420 (a 68.7% gain)

- 2014 saw a rise from £250 to £420 (a 68.0% gain)

3. Selling Too Soon Can Be Painful

The analysis highlights that newer vintages have been affected by global shocks such as COVID. Since 2019, we see consistent negative deltas in year-on-year release prices and a similar negative growth when comparing Market Price to Ex-London price, such as:

- 2023 shows a -3.7% delta / -12.90% growth, and

- 2021 shows a -19.7% delta / -1.79% growth

This suggests that immediate reselling after release is less profitable, reinforcing that value accrues significantly only with time. The 2021 vintage in particular highlights the effect of COVID and that a significant negative year-on-year delta doesn’t necessarily reflect an excellent buying opportunity.

4. Mature Market Recognition and Consumer Preference

Older vintages tend to gain favour in the secondary market as they near their optimal drinking windows. This maturity increases desirability, contributing to higher pricing and liquidity among collectors and consumers.

Conclusion:

Holding high level Bordeaux wines such as Château Batailley for the long term leverages the natural appreciation curve evident in secondary market trends. Investors and collectors alike benefit from the aging process, not just in quality but in considerable financial returns as shown by historical price deltas. Therefore, patience in wine investment, particularly with established names like Château Batailley, is financially prudent.