Understanding the Gap

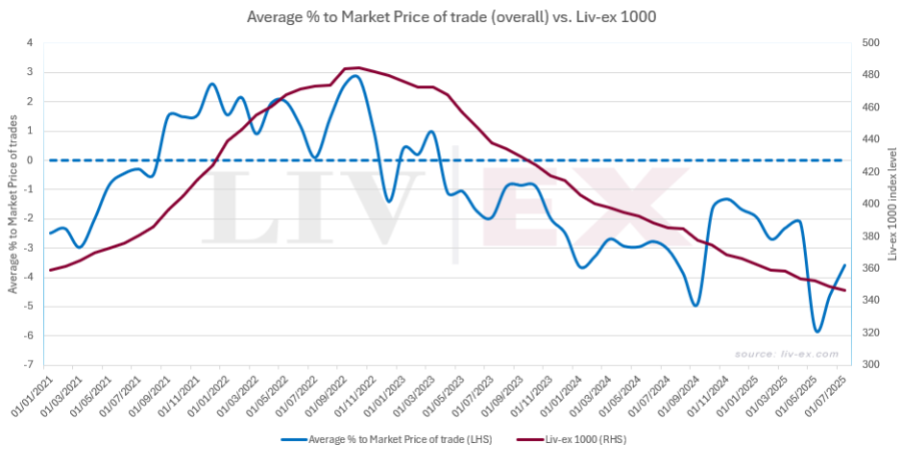

In stronger market conditions, trades tend to execute much closer to Market Price. That makes intuitive sense: when prices are moving upward, bids get pulled higher to meet offers; when markets weaken, offers are drawn down to meet bids. As trade prices climb, Market Price follows, as merchants seek to maintain or improve their margins.

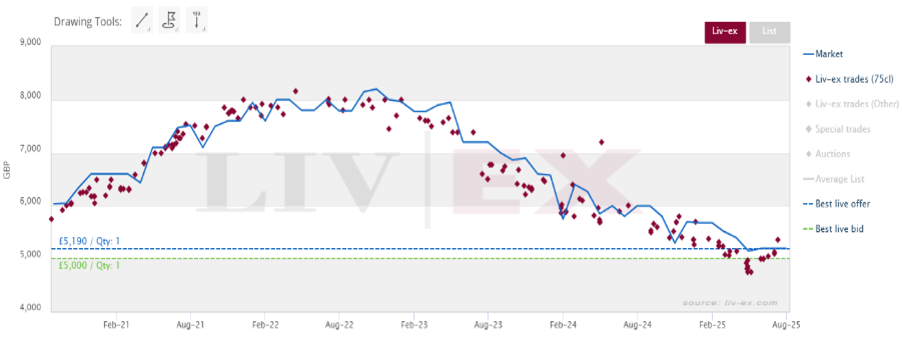

But what about when buyers pay above Market Price? At first glance this may appear irrational. Yet in practice, it often occurs in rising markets. Chateau Lafite Rothschild 2016 provides a clear example: when momentum is strong, buyers are willing to transact above Market Price on the assumption that demand will continue to drive values higher. In addition, securing highly sought-after stock can feel more difficult in these periods, which further encourages aggressive bidding.

As momentum slows, the reverse happens. Sellers begin to exit their positions, trading thins out, and while Market Price initially holds up, merchants eventually reduce their list prices in order to compete. Importantly, prices tend to fall more slowly than they rise, leading to a lag between Market and trade prices, with the market rice leading. Once values stabilise, the two move back into alignment, signalling a healthier equilibrium between buyer appetite and seller expectations.

Liv-ex trades of Lafite 2016

A Window into Sentiment

Though not a perfect measure, the distance between trade prices and Market Price can act as a useful proxy for market sentiment. Earlier this year, optimism was easy to spot: in Q1 2025, prior to the Trump tariff threats, trades consistently executed near or above Market Price. By contrast, May brought a sharp dip, as buyers – particularly in the US – retreated. Encouragingly, the most recent data shows a bounce back, with trades moving closer once again to Market Price.

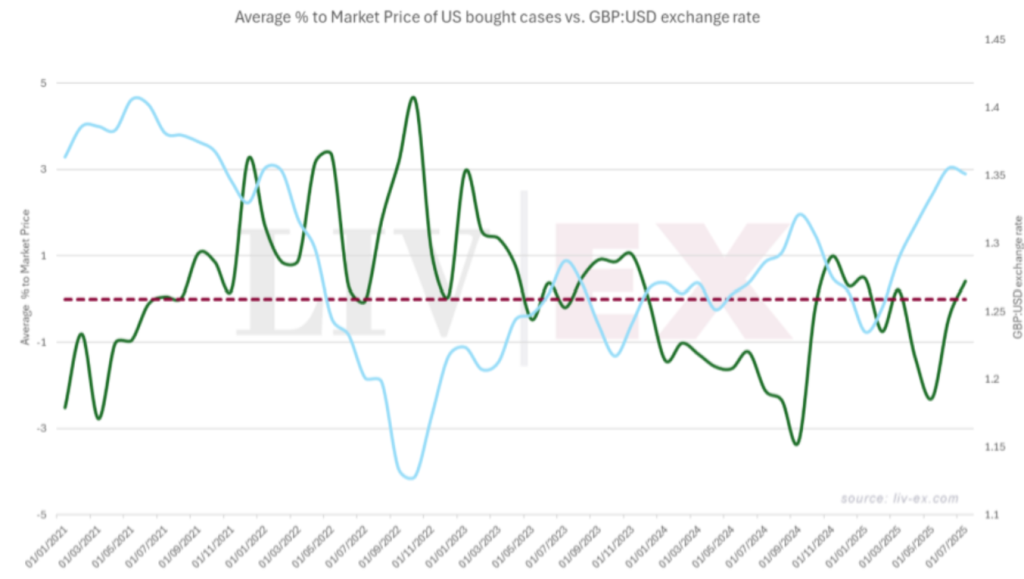

The Role of US Buyers

US demand plays an outsized role in this dynamic. Historically, US buyers transact closer to Market Price than their counterparts in other regions. With their benchmark values sitting around 34% higher than the Liv-ex Market Price, they can afford to bid competitively, transact quickly, and still realise profit at home.

Their influence is closely tied to currency. When the Dollar strengthens against Sterling, US buyers are able to pay at or above Market Price without sacrificing margin, helping to set a higher floor for trade. Conversely, when the Dollar weakens, the market feels it almost immediately. May’s downturn – coming on the heels of tariff announcements and a Dollar devaluation – was a prime example.

Looking ahead, with a 15% tariff now seemingly fixed, a stronger Dollar would be the most welcome sign for those looking for recovery in the second half of the year.

Key Takeaways

- Trade vs. Market Price is normal: The two rarely align perfectly; the gap reflects how buyers and sellers interact in real time.

- Rising markets narrow the gap: Buyers often pay close to – or even above – Market Price when momentum is strong and supply is tight.

- Falling markets widen it: Merchants are slower to reduce list prices than they are to raise them, creating a lag as trade prices drop first.

- Sentiment matters: The distance between trade and Market Price provides insight into confidence levels across the market.

- US buyers are a driving force: Their competitive bids, shaped by tariffs and currency shifts, can set the tone for global trade.