Market Insight – June 2025

A Vintage Without Pull

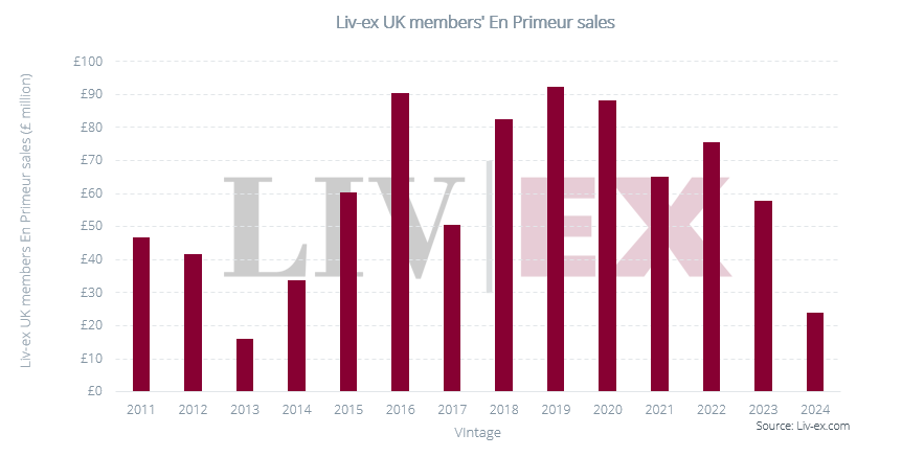

Expectations were cautiously optimistic: a small, difficult vintage like 2013, it might have encouraged pricing discipline and present genuine value to buyers. Yet the campaign began poorly, with Pontet-Canet pricing above market levels. It quickly became clear that pragmatic pricing, not brand prestige, would determine participation.

While many châteaux made commendable efforts to lower prices, cheaper and often better-rated back vintages remained widely available. Even when releases were well-priced, private collectors often stayed away – a signal that price alone is not enough to revive trust.

Market Conditions and Mixed Critic Reception

Critics were split. William Kelley (The Wine Advocate) was particularly reserved about the vintage, while only Lisa Perrotti-Brown MW and James Suckling awarded any wines a potential 100-point score. Overall, 2024 sat just above 2013, but below 2014, 2017, and 2021 in quality.

Macroeconomic headwinds, cautious U.S. participation, and lingering tariff concerns further dampened demand – particularly from traditional strongholds in North America.

Price Cuts vs. Price Points

Much has been made of the 20–30% reductions from 2023. But those numbers can mislead. Release prices in recent years have often proven to be peaks, not floors. The point to En Primeur is to purchase the wine at its lowest price point. Many 2021s, a similarly rated vintage, are still trading below their release levels. For 2024s to work, they needed to undercut those vintages significantly.

Only a handful of wines – Lafite, Mouton, Carruades, Angelus, Calon Ségur, Léoville Poyferré, Lynch-Bages, and Petit Mouton – were released below all other vintages on the market.

What Worked and Why

Lafite’s pricing reset to 2014 levels made headlines yet even given this, it hasn’t sold out. Still, it did better than most. Mouton, Cheval Blanc, Montrose, Figeac, and Calon Ségur also generated modest buzz.

The standout was Carmes Haut-Brion. Priced at parity with the 2021 – and with limited production and distinctive winemaking – it struck a chord with collectors. It’s one of the few wines to show signs of upward movement post-release, a rare feat in this campaign.

Merchant and Collector Fatigue

This year confirmed what many have suspected: the old rules of allocation-based loyalty no longer apply. Merchants largely bought only what they sold, protecting only the most exclusive wines. Many are sitting on losses from previous campaigns, especially unsold 2021s, and are now reluctant to take on more inventory that risks immediate depreciation.

For collectors, trust is eroded. Years of underperformance and opaque pricing have pushed many to the sidelines – especially younger buyers less attached to Bordeaux’s legacy and more accustomed to transparency and optionality.

Demand Isn’t Dead – But It Is Discerning

Some argue that waning demand is to blame, not price. But the data tells a different story. When the price is right – as with Carmes or Lafite – there is still interest. Bordeaux’s appeal has always been built on volume, consistency, and relative value. It’s a region for the drinker, not just the trophy hunter. Value-conscious collectors still exist – and they’re watching closely.

A Way Forward?

This campaign was a wake-up call. The system is not broken beyond repair, but the old assumptions no longer hold. En Primeur can still offer a compelling opportunity – if the value is clear, the pricing transparent, and the relationship between merchants and collectors grounded in trust.

For investors, this reinforces a broader truth: in today’s fine wine market, reputation is no longer enough. Rational pricing, quality, and scarcity – coupled with transparent distribution – are the true drivers of demand.