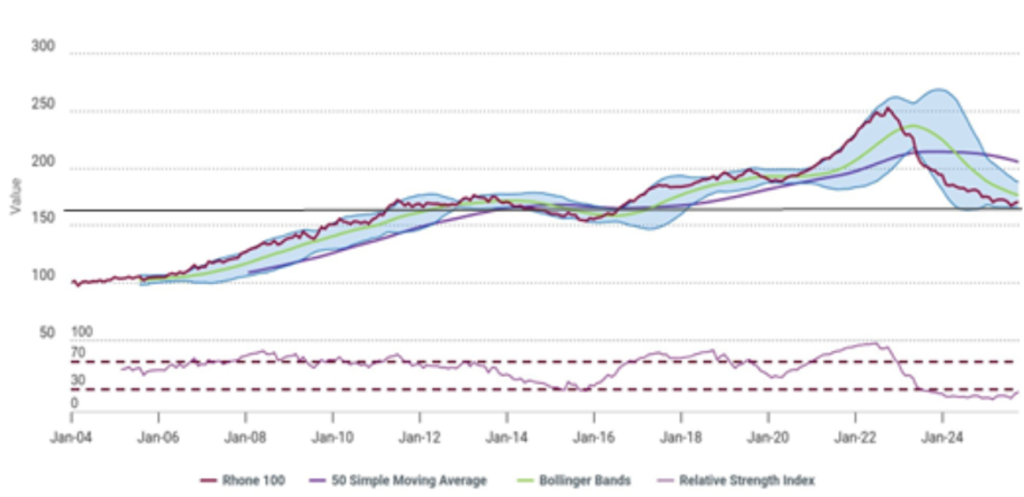

After several years of underperformance, there are finally signs that the Rhône might be stirring. The Rhône 100 has risen just 70.3% since inception, compared with the Liv-ex 1000’s 246.8% gain – a stark reminder of how quietly the region has trailed during wine’s broader bull runs. During this latest downturn, investors retreated to perceived safe havens like Bordeaux and Champagne, leaving the Rhône’s share of trade by value to slip from 4.5% in 2021 to only 2.6% year-to-date. The retreat of U.S. buyers, who once accounted for more than half of Rhône demand, has been another headwind.

Yet, at today’s levels, technical indicators suggest that this could be an inflection point. The Rhône 100 now sits between its 2014 peak and 2015 low, with volatility easing (as reflected by narrowing Bollinger Bands) and a steadily rising Relative Strength Index (RSI).

Technical Perspective

In late 2023, the Rhône 100’s RSI dropped below 30 – its first time entering oversold territory since inception. But while the index has continued to make lower lows, the RSI has begun making higher lows, signalling a bullish divergence. This pattern, alongside stabilising prices for key components, hints that the current support zone may hold.

Spotlight: Château Rayas

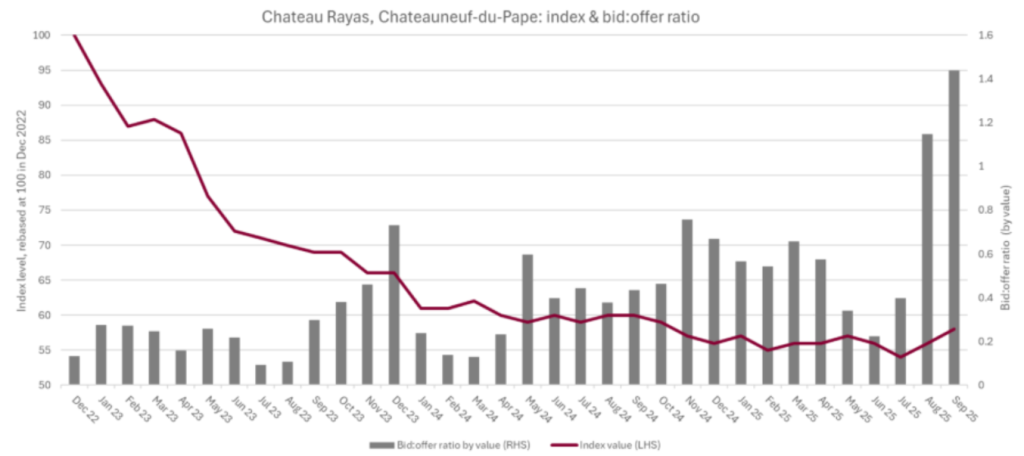

Château Rayas has long been the Rhône’s star performer – and its recent resurgence may tell us more about the broader market than it does about any one producer. Like Burgundy’s blue-chip names and Champagne’s cult growers, Rayas prices fell sharply when the fine-wine market turned. But after two years of declines, buyers are creeping back in.

In August, Rayas’s bid-to-offer ratio climbed above 1 for the first time since February 2022. As of 20 October, it stands at 1.58, meaning demand now decisively outweighs supply. This uptick is meaningful: when demand returns for top-tier wines – those carrying the most risk – it often marks renewed confidence across the secondary market.

Vintage Breakdown

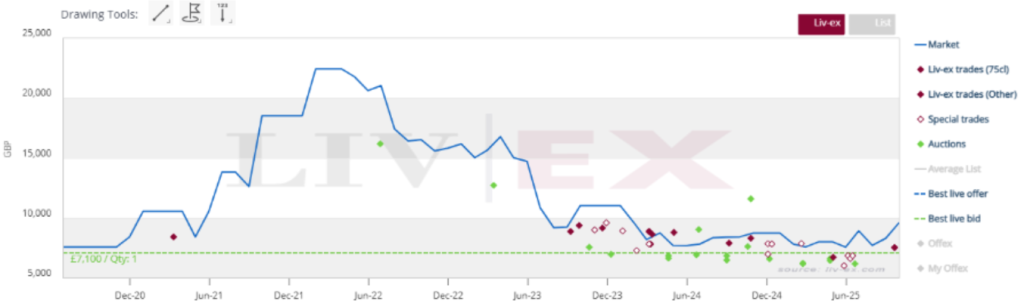

So far in 2025, the 2011 vintage has been the top-traded Rayas by value. After a two-year lull, its Market Price rebounded to £7,500 per 12×75, up 25% from its June low of £6,000.

The 2012 vintage tells a similar story, with steeper declines but a similar landing point around £7,500.

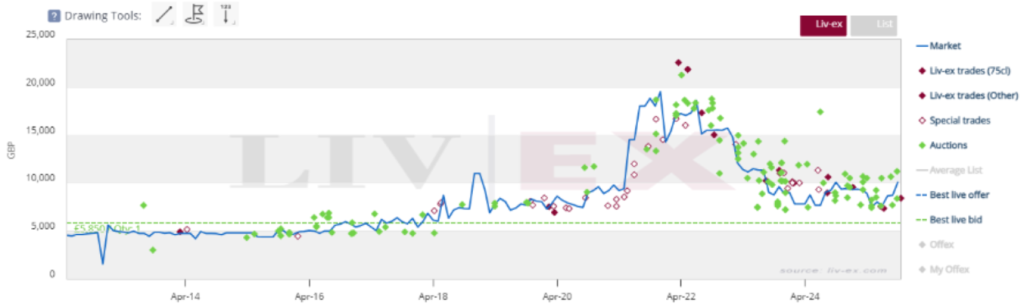

Meanwhile, older vintages such as the 2007 are showing a classic reversion-then-recovery pattern: a drop back to 2020 levels, followed by rising trade activity and firmer auction results.

Outlook

While the Rhône’s recovery won’t happen overnight, early signs of stabilisation – and the re-emergence of demand for icons like Rayas – suggest that patient investors could find value here. If the broader market recovery continues, today’s Rhône prices may come to look like a rare buying opportunity.