THE FINE WINE MARKET

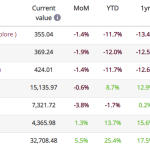

In September, two sub-indices of the Liv-ex 1000 experienced growth: the Italy 100 by 0.6% and the Rest of the World 60 by 0.2%. October witnessed a further 0.2% increase in the Rest of the World 60 index, predominantly driven by the performance of Californian wines. This index comprises ten of the most recent physical vintages of renowned labels such as Vega Sicilia Unico, Seña, Screaming Eagle, Opus One, Dominus, and Penfolds Grange.

Within the Rest of the World 60 index, 53% of Californian wines demonstrated positive movement in October. The top three performers in the index were all from the region, with Screaming Eagle 2015 rising by 11.1%, Screaming Eagle 2012 by 11.0%, and Dominus 2011 by 11.1%. However, it’s important to note that despite these notable monthly increases, these three wines have experienced significant year-to-date declines in their overall performance.

THE WINE SPECTATOR’S ANNOUNCES IT’S TOP WINES OF THE YEAR

It’s time for this year’s top wine rankings. James Suckling has already released the ‘Top 100 World Wines 2023 and Wine of the Year,’ with Laurent-Perrier’s Champagne Grand Siècle Iteration N.26 claiming the top spot and The Wine Enthusiast’s Top 100 Cellar Selections 2023 picked Poggio di Sotto, Brunello di Montalcino 2018, as its top recommendation.

This week, the Wine Spectator has been gradually revealing its top ten wines of the year, building up to the announcement of the ultimate pick later today. The full top 100 list will be disclosed early next week. Publication day for the listed wines is akin to Christmas, as evidenced by the past few years, where most of the Wine Spectator’s top wines have seen considerable trading activity and a subsequent increase in price.

LIV-EX CHAMPAGNE 50 INDEX SHOWS CONTINUING BULLISH TREND

Recent price action for the Liv-ex Champagne 50 index aligns with the correction discussed since March 2023. Despite a 20% drop ytd, the correction is viewed in the context of the significant upswing from early 2020. The Simple Moving Average 50 months (SMA50) and rising trendlines, depicted in blue, indicate that the bullish trend remains intact even as the index moves downward.

The Relative Strength Index (RSI) signals clear bearish momentum, having crossed the ‘30 line’ in September, entering oversold territory. With Bollinger Bands (BB) widening in September and October, coupled with limited support around the current price level, bearish momentum is likely to persist. There is no technical sign indicating the end of the ongoing correction.

THE UK

UK stocks experienced a decline during October, with notable underperformance in major British banks due to apprehensions regarding the potential negative effects of increased interest rates on their lending activities, especially in mortgages. Concurrently, worries about the well-being of the UK consumer impacted various domestically focused sectors, contributing to the downturn in small and mid-cap (smid) equities.

Long-term market interest rates rose again as gilts resumed their sell-off after a relatively stable period in the summer. The UK’s economic outlook deteriorated, marked by a significant decline in consumer confidence, a drop in key purchasing manager indices, particularly in the construction sector, and reports of further declines in house prices.

THE EUROZONE

Eurozone equities experienced a decline in October, with traditional safe-haven sectors like utilities and consumer staples posting modest gains for the month. Energy and information technology exhibited relative resilience, while other sectors faced more pronounced drops. Healthcare, in particular, emerged as one of the weakest performers following a significant pharmaceutical company’s announcement of a lower profit outlook for the coming year.

In its October meeting, the European Central Bank (ECB) opted to keep interest rates unchanged, interrupting a series of 10 consecutive increases. Towards the end of the month, data revealed a decrease in annual inflation to 2.9% in October from 4.3% in September. This news, indicating a return of inflation closer to the ECB’s 2% target, fueled expectations that the current cycle of interest rate hikes might be concluding.

THE USA

In October, US equities declined as the anticipated conclusion of the Federal Reserve’s (Fed) tightening policy was postponed. Despite persistent inflation and a robust overall US economy, uncertainties surrounding the timeline for policy adjustments persisted. Ongoing conflicts, such as the war in Ukraine and fresh tensions in the Middle East, added to the economic backdrop.

The US economy surpassed expectations, expanding at an annualised rate of 4.9% in Q3 2023, outpacing market forecasts of 4.3% and accelerating from the 2.1% growth in the preceding quarter. Strong consumer spending primarily drove this growth. Over the 12 months ending in September, the Consumer Price Index (CPI) showed a 3.7% increase, maintaining the same level as the previous month. Indicators of industrial activity, such as the Purchasing Managers’ Index (PMI), also suggested expansion, with the October flash composite reaching 51.0, up from September’s 50.2 (a reading above 50 signals expansion).