The UK Enters Two Trade Deals, South Asia Tensions & Moving Markets

Economic Recap: Jobs, Central Banks & Markets

U.S. Jobs Report:

April’s nonfarm payrolls rose by 138,000, down from 228,000 in March, reflecting growing uncertainty from ongoing trade and fiscal policies. NFPs is an economic indicator that measures the number of new paid workers (month to month) in the US economy, excluding farm workers, government employees, private household staff, and non-profit workers. Unemployment held at 4.2%, while wage growth edged up 0.3% month-on-month.

Bank of England Rate Cut:

The Bank of England cut its main interest rate (the Base Rate) by 0.25 percentage points to 4.25% on Thursday, despite an unexpected three-way split among policymakers as U.S. President Donald Trump’s tariffs weigh on global economic growth. The pound softened slightly against the dollar, while U.K. equities rallied on hopes of a more dovish monetary stance through summer.

Eurozone Developments:

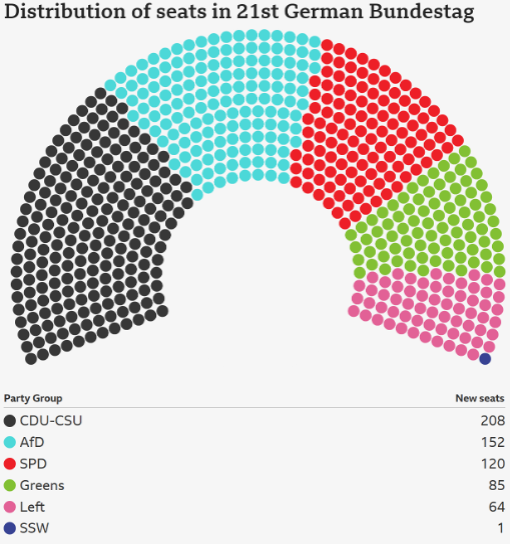

In Europe, the European Central Bank (ECB) held rates steady, with officials signalling a likely cut in June depending on inflation data. Meanwhile, German industrial output fell 1.2% month-on-month in March, raising concerns over the eurozone’s tepid recovery. The Euro Stoxx 50 posted modest gains, though sentiment remains cautious. Friedrich Merz finally became German Chancellor through a coalition with the centre-left Social Democrats. Earlier in the week he suffered the ignominy of being their first post-war German party leader to ask the Bundestag to confirm him as Chancellor and lose – by 6 votes. According to accounts Alice Weidel, co-chair of the far-right AfD party was audibly heard to be laughing when the vote was announced. The AfD are the second largest party in the 21st Bundestag, so there are difficult days ahead for Herr Herz.

Corporate Earnings:

Roughly 76% of S&P 500 firms beat earnings expectations this week, with Microsoft, Meta, and Apple posting strong results. However, Apple’s cut to its buyback program and Amazon’s soft guidance raised investor concerns.

Market Overview:

- S&P 500: +1.4% weekly

- Dow Jones: +1.6% weekly

- Nasdaq Composite: +1.9% weekly

- FTSE 100: +1.2% weekly

- Euro Stoxx 50: +0.9% weekly

- Gold: -0.6% as risk appetite returned

- Copper: +1.9% on China optimism

India-Pakistan Tensions Escalate

India launched airstrikes inside Pakistan on May 7th, following a deadly attack in Indian-administered Kashmir that killed 26 civilians. The Indian retaliation resulted in 31 deaths and prompted Pakistan’s Prime Minister Shehbaz Sharif to authorise military counteraction, with Army Chief Asim Munir placed in operational control. As military readiness increases on both sides, the threat of broader conflict looms large.

These developments have already had economic repercussions. The Indian rupee weakened slightly, and regional equity markets, particularly in Mumbai and Karachi, posted intraday losses before recovering on hopes of diplomatic de-escalation.

U.K.-India Trade deal

After three years of talks, the UK and India have agreed a free trade deal that both sides say will double bilateral trade between the world’s fifth and sixth-largest economies by 2030. Trade experts said the overall deal – which will increase long-run UK GDP by 0.1 per cent a year, according to the government – was focused more heavily on goods than services, reflecting New Delhi’s longtime reluctance to open its markets in those areas. Big UK winners will be whisky and gin producers, which will see tariffs halve to 75 per cent immediately and fall to 40 per cent by the 10th year of the deal. Karen Betts, chief executive of the Food and Drink Federation, a lobby group, welcomed the deal as a “significant opportunity” to increase exports of UK food and drink products to India, which hit almost £300mn in 2024.

U.S.-China Trade Talks Restart

For the first time since the onset of their trade standoff, U.S. and Chinese officials will meet in Geneva. With both sides having imposed steep tariffs (145% by the U.S., with retaliatory duties from China of 125%), hopes are cautiously rising for a thaw. However, analysts warn that any breakthrough will require months of structured negotiation. Trump today posted on social media “80% Tariff on China seems right! Up to Scott B.” Scott B being Scott Bessent the US Secretary of the Treasury who travels to Switzerland to meet with Chinese officials. Although neither the US or China confirmed who would be representing China in the talks, Vice Premier He Lifeng is widely viewed as China’s economic czar and chief trade negotiator.

Markets responded positively, with the S&P 500 posting a 1.4% weekly gain and copper prices jumping nearly 2% due to optimism over improved Chinese import conditions. Still, bond markets remain volatile amid concerns that stalled trade could weigh on global growth.

U.K.-U.S. Trade Agreement Announced

President Trump and U.K. leaders unveiled a new trade agreement this week. Key provisions include the reduction of auto tariffs from 27.5% to 10% (within a 100,000-vehicle quota) and expanded access for U.S. beef, ethanol, and machinery.

While the pound remained stable, U.S. exporters welcomed the move, and U.K. hospitality stocks saw a mild uptick in anticipation of reciprocal consumer demand. This deal could serve as a template for similar agreements amid ongoing global trade tensions. Having said all that, many commentators are stating that this is less a trade deal and more a working template. The U.S. are still unhappy with the blocking of chlorinated chicken and GM beef being admitted to the U.K. Farmers in the U.K. will also be smarting following Rachel Reeves’ inheritance tax raid on their farms, whilst admitting U.S. produce.

U.S.-Philippines Military Drills Near Taiwan

The U.S., Philippines, and Australia launched the large-scale Balikatan military drills this week. Held near Taiwan, these exercises are designed to boost preparedness in the face of rising Chinese assertiveness in the region. Although officials avoided naming China directly, the geopolitical messaging was unmistakable.

While local markets held steady, energy prices briefly spiked on fears of potential disruptions in South China Sea trade routes. Analysts remain wary of how these exercises might escalate tensions in the Asia-Pacific region.

Taiwan’s President Sounds Alarm

Taiwanese President Lai Ching-te compared Taiwan’s current geopolitical environment to Europe in the 1930s, warning of rising authoritarianism and stressing the need for democratic unity. His comments follow increased Chinese aerial activity near Taiwanese airspace and highlight a growing risk to regional stability.

China Eyes ASEAN-GCC Alliance

Chinese Premier Li Qiang announced plans to attend the ASEAN-GCC-China summit later this month in Malaysia. The goal is to expand Beijing’s diplomatic and trade footprint amid its tense standoff with the U.S. Analysts expect discussions to centre on supply chain resilience and energy security.

China’s strategic pivot toward the Gulf and Southeast Asia signals a broader realignment in global trade patterns, especially as Western economies pursue decoupling.

Russia Victory Day Parade

As Russia held its May 9th Victory Day parade, the Kremlin continues to project strength despite mounting fatigue from the prolonged war in Ukraine. This year’s parade featured a Chinese honour guard, symbolising deepening Moscow-Beijing ties. Military analysts noted a possible surge in disinformation and hybrid warfare tactics accompanying the event.

Oil prices ticked upward ahead of the parade, partly on concerns of escalated hostilities. Brent crude finished Thursday at $62.20, while WTI ended at $59.30.

Final Thoughts

This week offered a vivid reminder of how deeply interconnected today’s geopolitical and economic worlds are. Military tensions in Asia, high-stakes trade diplomacy, and fragile global markets all converged – underscoring that investors and policymakers alike must stay alert to shifting sands.

As talks restart, drills expand, and alliances realign, the coming weeks will be pivotal in shaping the trajectory of 2025’s global order.