Yesterday, the first Labour Government Budget was presented to the House of Commons, and like many, I found myself racing to crunch numbers and reach out to accountants for advice. Two key updates stood out: Capital Gains Tax (CGT) and Inheritance Tax (IHT) reforms.

Capital Gains Tax (CGT)

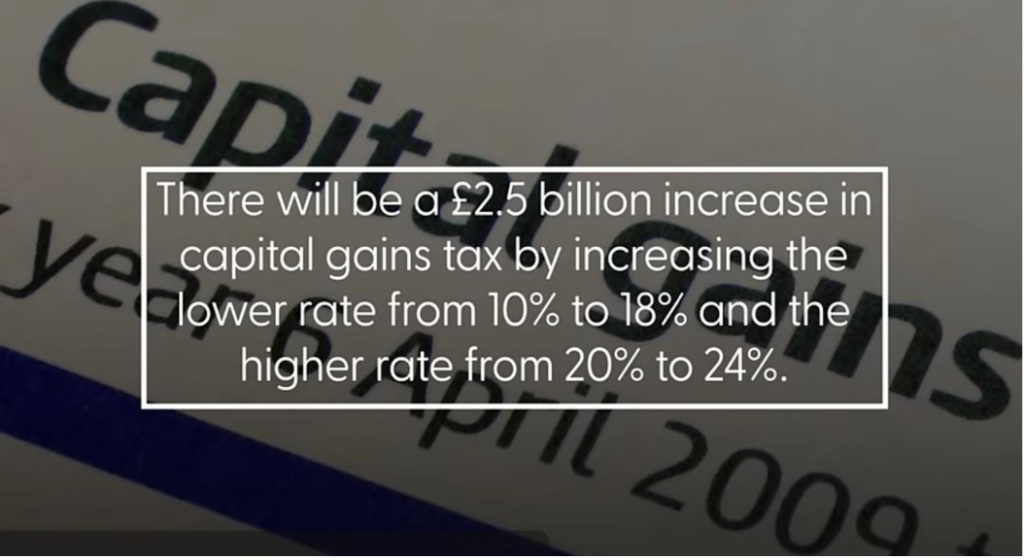

CGT reform was one of the most anticipated changes, and here’s the outcome:

- Residential Properties: CGT rates remain the same, with no increases.

- Non-Residential Assets: Immediate increases for CGT rates, moving from 10% to 18% for lower-rate taxpayers and from 20% to 24% for higher-rate taxpayers.

For private landlords, this is welcome news as the CGT regime is unchanged. However, investors with share portfolios will feel the impact of increased CGT rates, compounded by the reduced CGT annual allowance, which has dropped from £12,300 to £3,000 over the last two years.

In practical terms, on a £20,000 profit (after the £3,000 allowance), the increased CGT means:

- £1,360 for lower-rate payers

- £680 for higher-rate payers

Inheritance Tax (IHT)

Inheritance Tax is never a welcome topic, and the proposed changes affect estates significantly:

- Agricultural and Business Assets Relief: 100% relief remains for the first £1 million in assets. For values exceeding this, IHT will apply at a reduced rate of 20%.

- AIM Shares Relief: Previously fully exempt, AIM shares will now benefit from only a 50% IHT relief, although unlisted private company shares still enjoy a 100% exemption for the first £1 million.

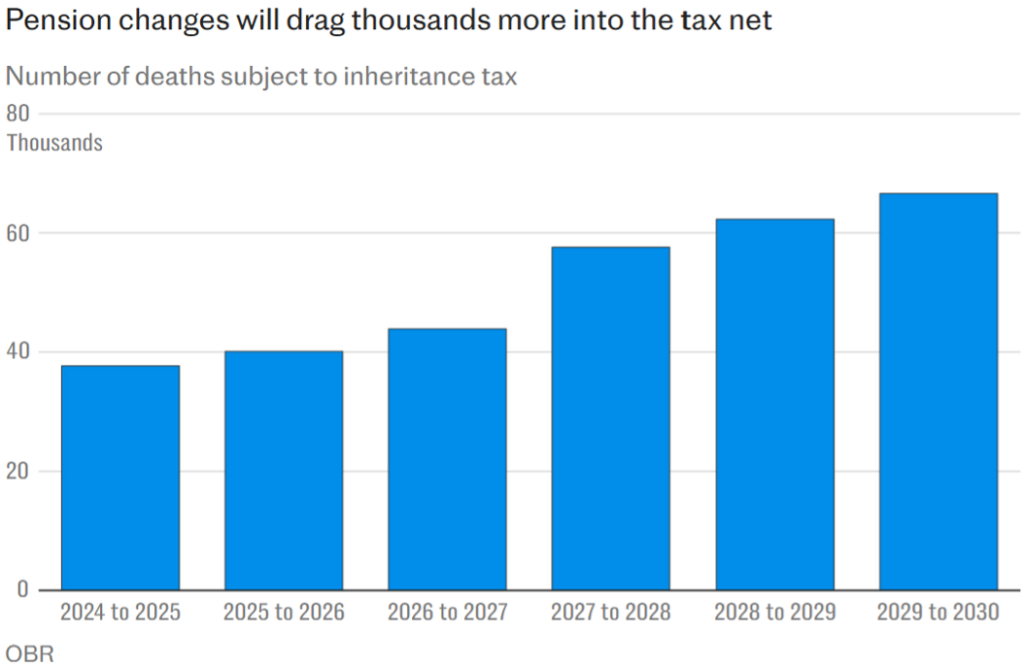

- Pension Funds: From April 2027, unused pension funds will count as part of the estate for IHT purposes.

Business Asset Disposal Relief (BADR) will also see changes. The CGT rate under BADR is set to increase from 10% to 14% in 2025, reaching 18% in 2026. For those using BADR as a way to limit the effect CGT, when disposing of part or all of their business interests, given that the rate of CGT for higher rate taxpayers is being increased to 24% the marginal relief will be effectively 6% – currently it is 10%.

General IHT Thresholds remain frozen at £325,000 but are extend until 2030 (from 2028), reducing the inflationary benefit on estate planning thresholds.

ISAs

Savers were also hit in real terms (inflation adjusted) as the Chancellor froze the Isa allowance until 2030. Currently, UK savers can invest £20,000 in an Isa tax free. However, this maximum limit hasn’t changed in 13 years and its continuation until 2030 will force savers into non-Isa related products to save for their future – expected to raise £1bn for the Treasury in taxes due on these investments. If the annual limit had risen in line with inflation, it would stand at just shy of £26,000.

Wine & Whisky: A Tax-Efficient Opportunity

Amidst these changes, the wine and whisky markets remain notably unaffected. Both wine and whisky casks continue to be exempt from CGT, making them ideal additions for estate planning strategies.

Given the significant shifts in CGT and IHT, now is the time to connect. Let’s explore how wine and whisky investments could complement your portfolio, offering potential returns and estate planning benefits in a tax-efficient manner.

(please note that this is not to be viewed as investment advice and is only to be viewed as an opinion)