How the US Tariffs are affecting central bank rates & savings.

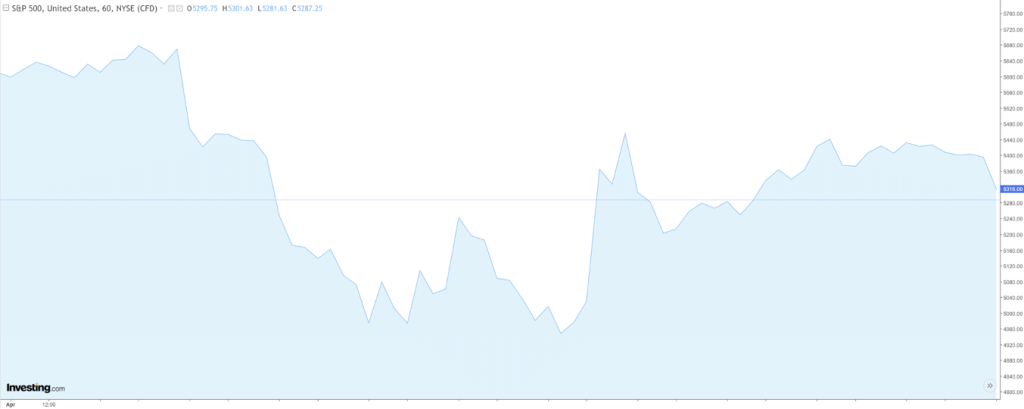

Equity Markets in Retreat

Major U.S. stock indices have suffered substantial losses as investors grapple with the ramifications of the new trade measures. The S&P 500 fell 2.2% to 5,275.70, the Dow Jones Industrial Average declined 1.7% to 39,669.39, and the Nasdaq Composite dropped 3.1% to 16,307.16 on April 16. Year-to-date, the Nasdaq and Russell 2000 have declined 15.6% and 16.4%, respectively.

The initial market optimism following a 90-day tariff pause announced on the 9th April has dissipated, overshadowed by the persistence of steep tariffs on Chinese imports, now at 145%. This selective approach has done little to alleviate investor concerns, as evidenced by the continued sell-off in technology and industrial sectors.

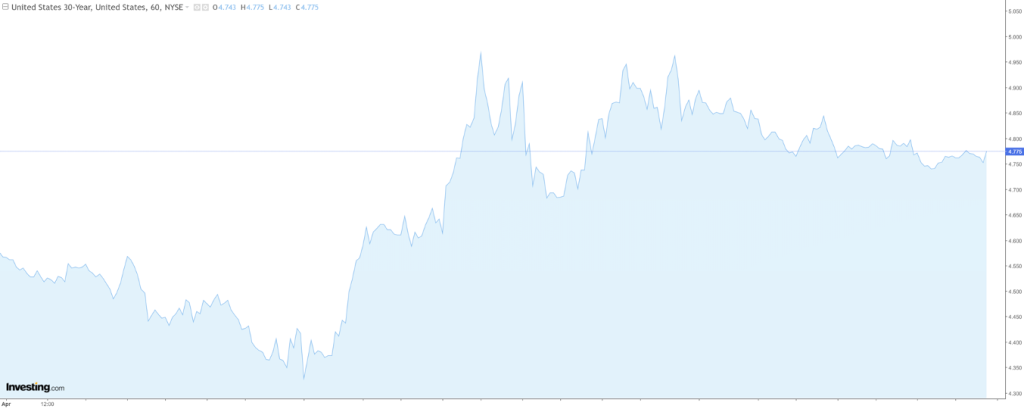

Bond Market Volatility

Contrary to traditional market behaviour, U.S. Treasury bonds have not provided a safe haven amid equity market turbulence. Instead, a sharp sell-off in long-dated Treasuries has occurred, with the 30-year yield experiencing its largest one-day rise in three years, reaching 4.92%. This unexpected movement has prompted comparisons to the 2022 U.K. bond crisis and raised concerns about the stability of the world’s largest bond market.

The Bank of England responded to similar volatility by postponing a £600 million auction of long-dated government bonds, opting instead to sell £750 million in short-dated bonds. This strategic shift underscores the global impact of U.S. trade policies on financial markets.

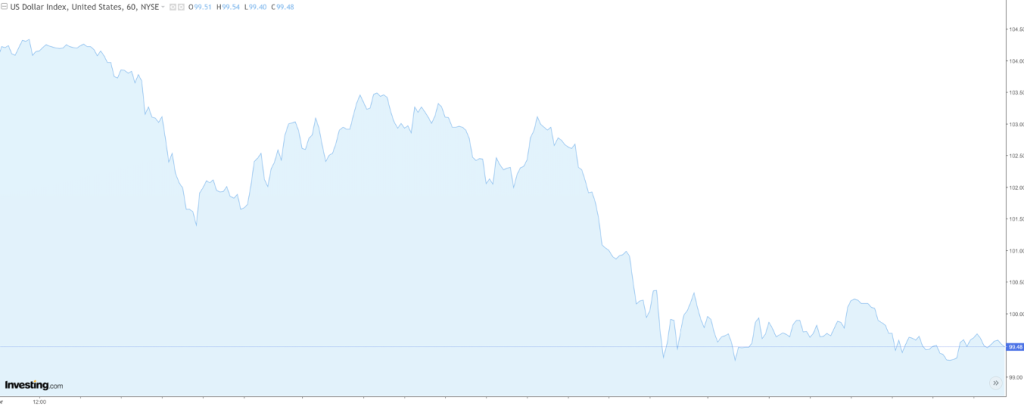

Investor Sentiment and Outlook

Institutional investors are increasingly bearish on U.S. assets, with a Bank of America survey revealing record pessimism toward U.S. stocks and the dollar. Over 60% of fund managers expect the dollar to depreciate, and allocations to U.S. equities have seen the steepest decline in history over a two-month period.

Technical analysts, such as David Keller of Sierra Alpha Research, caution that the market’s downward trend may persist without clear improvements in trade policy and economic indicators. Keller advises investors to consider defensive sectors like consumer staples (think physical assets) and gold as safer investment opportunities amid ongoing volatility.

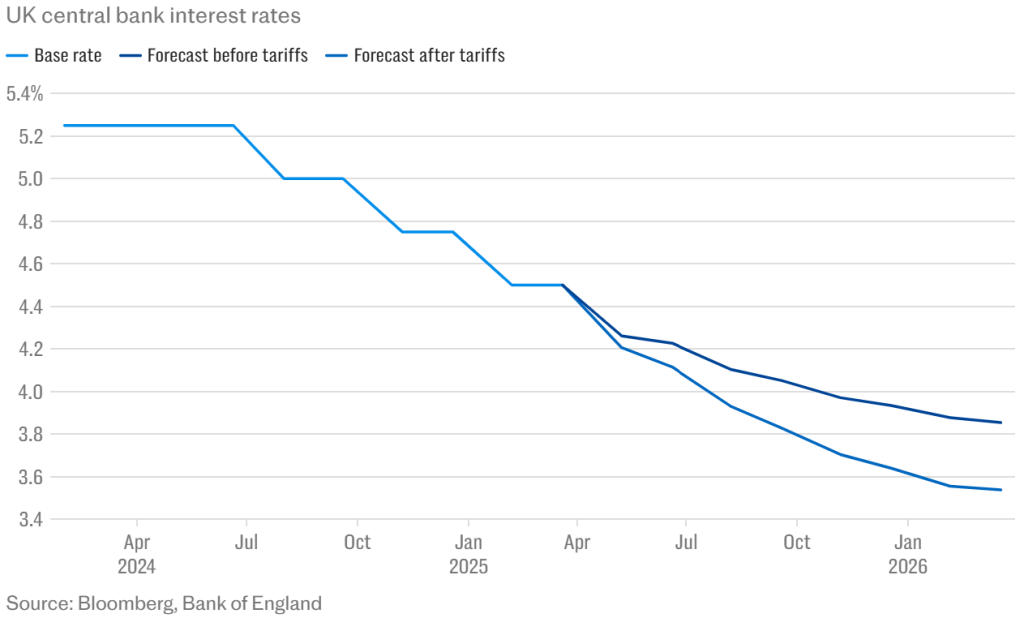

Central Bank Rates

Yet to be digested fully is Trump’s comments in Truth Social where he stated “Jerome Powell’s termination cannot come fast enough.” Market commentators are confused as to whether this means Trump will find a way to dismiss him, or whether his comments allude to being ready for Powell’s term to finish in 2026. For his part, on Wednesday, Chair Powell commented at the Economic Club of Chicago that higher-than-expected tariffs announced in recent weeks could result in slowing US economic growth and rising prices for consumers. In the UK, traders and commentators see the potential for the Bank of England Base Rate dropping below 4%, following the ECB’s decision to lower rates today. James Blower, of the Savings Guru, said: “The turmoil from the Trump tariffs has moved us in the direction of sub-4% Bank Rate come the end of 2025. This will not be good news for savers and, if we were to see a Bank Rate of 3.75% by the year end, then we can expect to see best buy easy access rates and one-year fixed rates fall below 4%.”

This means that, on the one hand, borrowers with variable rates will get some respite and potential borrowers could be tempted to come into the market. However, savers are going to be hit.

In the UK, the favoured Isa (Individual Savings Account) will be hit with lower returns and the UK Chancellor of the Exchequer, Rachel Reeves, has confirmed that she is looking to change the Isa regime. Documents following her Spring Statement have revealed that she is looking to reduce the current tax-free allowance of £20,000 to £4,000.

ISAs have been a favoured way in the UK for individuals to bump up pensions as they work. However, this is looking to changed.

So, this raises a vital question: How can you safeguard and grow your retirement savings in such an unpredictable environment?

One solution lies in diversifying your portfolio into the fine wine and rare whisky markets. These tangible, time-tested assets provide several key benefits:

- Low Correlation to Stock Market Volatility: Unlike traditional investments tied to equities, fine wine and rare whisky have historically shown resilience during market downturns. They offer a way to protect your capital from the unpredictable fluctuations of the stock market.

- Steady, Long-Term Value Growth: Over the past few decades, fine wine and rare whisky have consistently appreciated in value. The demand for high-quality vintages and rare releases has steadily outpaced supply, creating a stable upward trend that can contribute to your retirement fund. Indeed, an auction focused collection of fine wine and rare whisky has the potential to offer not only a healthy pay day at sale, but also the capability to liquidate the collection at one go.

- A Broader Range of Opportunities: With careful selection, you can identify wines and whiskies with strong historical performance and favourable market conditions. This strategic approach helps ensure you’re investing in assets that align with your retirement goals, rather than relying solely on traditional pensions or savings accounts.

By shifting a portion of your pension savings strategy to fine wine and rare whisky, you’re not just diversifying – you’re protecting your future against the uncertainties of today’s financial landscape. In an era of diminishing returns and increased volatility, these alternative investments offer a stable and rewarding pathway toward a more secure retirement.