The Burgundy producer’s broad appeal and scarcity continues to create an attraction to collectors despite broader market caution.

Today’s Focus: A Glimmer of Optimism from Asia?

The Asian fine wine market has been subdued for several years. But in recent months, early signs suggest that a shift may be underway.

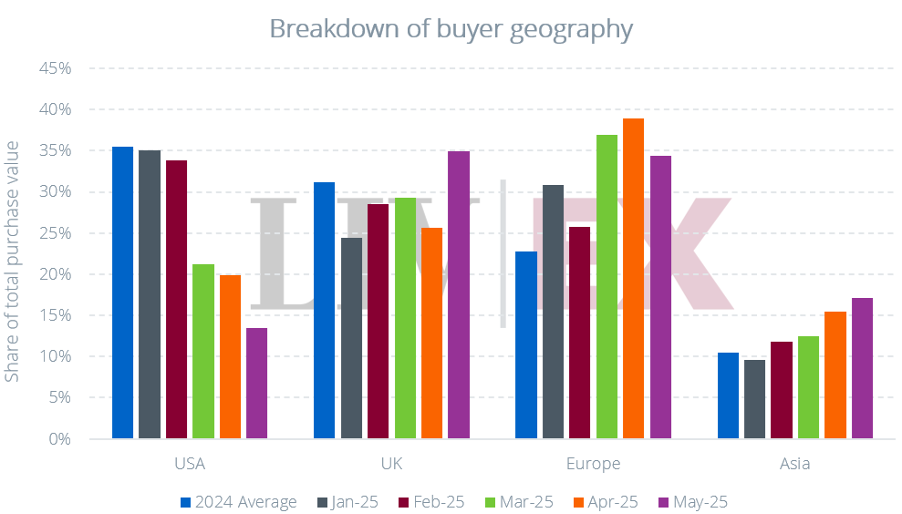

After a flat start to the year, Asian buying activity has increased steadily each month, both in terms of share of global trade value and absolute volumes. Notably, May saw:

- A 10.1% increase in Asian purchase value over April

- A 25.2% increase compared to May 2024

- A level 33.7% higher than the 2024 monthly average

While some of this reflects a slowdown in the US – a result of En Primeur fallout and tariff uncertainty – it is not merely a rebalancing. The absolute value of Asian purchases is rising, particularly in Burgundy.

What Are Asian Buyers Focusing On?

Over the past few months, the Asian market has shown renewed interest in Burgundy, while its longstanding commitment to Bordeaux appears to be evolving. This change in allocation preference is subtle but significant – and possibly cyclical.

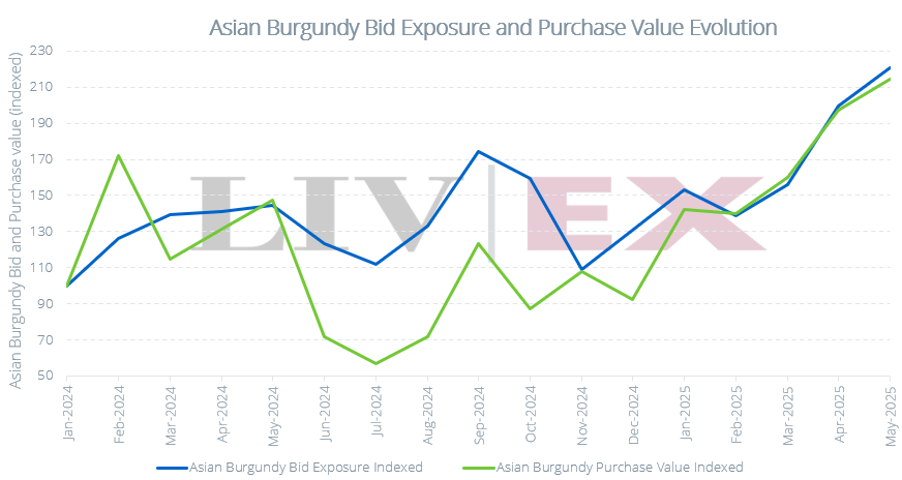

- Burgundy: Tight Supply, Increased Demand

Burgundy has seen a marked uptick in both bid exposure and trade value. April and May recorded the highest number of unique Burgundy buyers in Asia in over two years, suggesting renewed confidence in the wine region’s long-term value. Importantly, the nature of this buying appears considered: since November 2024, bid activity has increasingly mirrored actual trade value, implying intent-to-buy rather than speculative pricing.

This likely reflects two forces at play:

- Dwindling availability – With Burgundy’s notoriously small production volumes, stock turnover is faster than Bordeaux. As inventories run low, motivated buyers are stepping in.

- Price realism – Several sought-after Burgundy producers, including Coche-Dury and Roumier, have seen prices soften just enough to trigger re-entry from informed collectors.

This is especially true in Hong Kong, Singapore, and Tokyo, where demand is being driven not just by established connoisseurs but by younger collectors seeking scarcity, terroir transparency, and long-term capital retention.

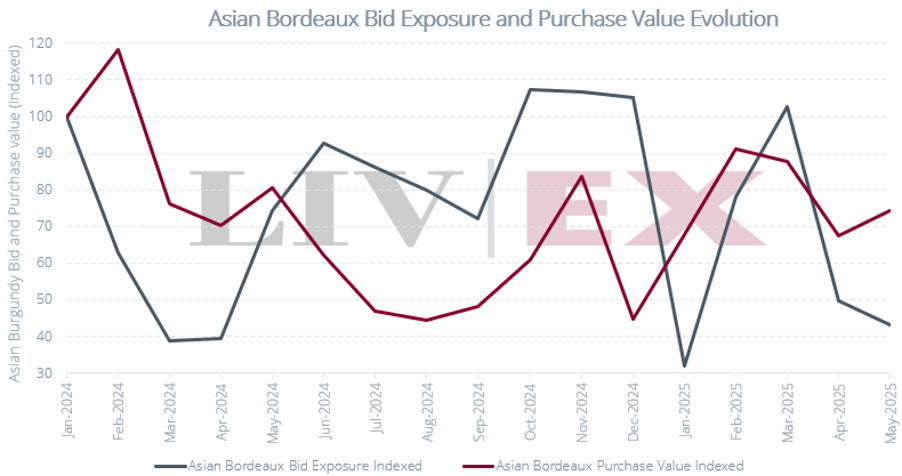

- Bordeaux: Still Dominant, But Volatility Remains

Bordeaux continues to account for the largest share of Asian purchases by value – but the lead is narrowing. Unlike Burgundy, bid exposure and trade value in Bordeaux remain erratic, suggesting continued hesitation.

One likely reason is oversupply. Many merchants still hold inventory from underwhelming campaigns, especially 2021s and 2022s, which have failed to maintain price stability. This backlog reduces urgency to replenish stocks – particularly as pricing on some recent vintages continues to correct downward. The 2024 En Primeur campaign would not have helped matters much on this front as well.

Yet it’s not all bearish: First Growths and strong value picks like Carmes Haut-Brion have still attracted attention, especially where releases undercut available back vintages.

- Whisky and Champagne

Although wine dominates the numbers, there is rising Asian interest in high-end whisky, particularly Japanese expressions from closed or limited-production distilleries. Similarly, prestige cuvée Champagne – notably Krug, Salon, and mature vintages of Dom Pérignon – is gaining traction, often as a luxury consumption play rather than investment.

Looking Ahead: Summer Watching Brief

It’s too early to call this a full rebound, but the signs are meaningful. With Europe heading into its traditional summer lull and the US market gripped by uncertainty over trade policy, Asia may be the region to watch in the second half of 2025.

Should this momentum continue – particularly if Burgundy stocks remain tight and prices stabilise – we could be witnessing the early stages of a regional revival. For long-term collectors and institutional players alike, staying close to Asian market signals will be key.