🍷 Fine Wine: A Growing Asset Class for Investors

Fine wine has long been a symbol of culture and connoisseurship. But increasingly, it’s also being recognised as a sophisticated asset class – and it’s making its way into the portfolios of high-net-worth (HNW) investors around the world. Once the preserve of seasoned collectors, today’s fine wine market is opening its cellars to a younger and broader generation of investors.

📊 A Surge in Wine Investment

Recent data shows that nearly 30% of HNW investors are now incorporating fine wine into their portfolios (source: WineCap 2024 Wealth report). What’s particularly noteworthy is that this surge isn’t just driven by established wine enthusiasts – it’s also fuelled by newcomers who see the sector as an accessible and stable complement to traditional assets when viewed as a long-term investment.

💼 Evolving Portfolio Allocations

In 2024, 66% of these investors allocated up to 10% of their portfolios to fine wine, while a notable 34% have invested more than 11% – and an elite 2% have allocated over 33%. This polarisation represents a significant shift from 2023, when no portfolio manager allocated more than 30% to wine (source: WineCap 2024 Wealth report).

This evolving trend reflects not only growing confidence in the sector but also a shift in how wine is perceived: not just as a luxury product, but as a resilient, tangible asset that can weather market storms.

🧠 Wine’s Role in Risk Profiles

Interestingly, fine wine is predominantly used in “somewhat” or “extremely” cautious portfolios, with 88% of US wealth managers seeing it as a stabilising asset alongside bonds and other liquid investments (source: WineCap 2024 Wealth report). Wine’s resilience to inflation and historic low volatility makes it an ideal anchor for portfolios focused on long-term security.

Only 2% of managers are taking a bolder approach, using fine wine in more aggressive portfolios – a move that speaks to the historical outperformance of wine in recessionary and inflationary environments.

🎓 A More Diverse Investor Base

The fine wine investment landscape is also evolving in terms of who is participating. In 2023, 62% of wine investors were highly experienced. Fast forward to 2024, and that number has dropped to 52%, as more moderate and novice investors join the ranks.

This demographic shift aligns with broader market trends: younger generations are increasingly seeking sustainable, low-carbon-footprint assets. Fine wine’s emphasis on heritage, craftsmanship, and environmental stewardship makes it a natural fit for this next wave of investors.

🌱 Sustainability Meets Sophistication

As we’ve mentioned before, the fine wine sector’s growing appeal is further bolstered by its alignment with sustainability values. Many estates are moving towards organic and biodynamic viticulture, which resonates with the preferences of millennial and Gen Z investors who prioritise environmentally responsible investments.

🍷 A Tangible Asset for Modern Times

Today, fine wine stands out not just as a pleasure for the palate, but as a genuine long-term investment vehicle. With its stability, inflation resistance, and cross-generational appeal, wine has become an essential part of the conversation for HNW investors seeking to balance risk, reward, and sustainability.

As the cellars open wider and the market grows more accessible, one thing is clear: fine wine has secured its place as a modern, tangible asset – one with a story in every bottle, and a future as bright as the finest vintage.

Weekly Fine Wine Market Snapshot

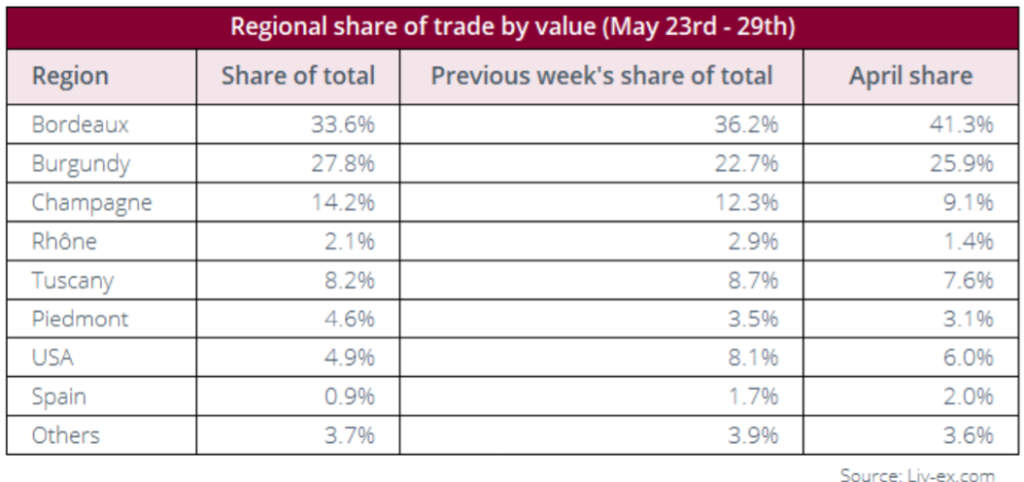

Bordeaux maintained its lead in global trade, via Liv-ex, though its share of traded value slipped to 33.6% this week. Beychevelle and La Conseillante were the most traded by volume, while Petrus and Château Lafite Rothschild led in value.

Burgundy saw a significant uptick, with its trade share climbing from 22.7% to 27.8%. Domaine de la Romanée-Conti took the spotlight, driven by strong trades in its 2019, 2016, and 2013 assortments. This trend showcases the long-term value that collectors are seeing at current price levels.

Champagne posted a solid performance as well, with its share rising from 12.3% to 14.2%. Cristal 2006 emerged as the most traded single wine, while Dom Pérignon was the top producer overall.

Tuscany held steady at around 8%, buoyed by healthy volumes of Sassicaia and Tignanello 2022, plus trades in Brunello wines like Biondi-Santi 2018 and 2019.

Piedmont secured a 4.6% share, with Giacomo Conterno’s Barolo Francia and Monfortino Riserva accounting for over half of the region’s activity.

Meanwhile, the USA saw its share drop from 8.1% to 4.9%. Opus One continued to trade across vintages, but it was Continuum 2019 that took the top spot by value.