Experience a rare evening of Italian white truffle and exceptional wines, perfectly crafted by Chef Giuseppe Silvestri, whether shared or enjoyed solo, each moment promises unmatched flavour and refinement.

Invest in premium whisky and fine wine

Welcome to Oeno Group — the leading wine and whisky investment company. We specialise in guiding investors through the enriching journey of fine wine and premium whisky investments, a niche yet increasingly popular method of diversifying investment portfolios.

Discover the indulgent and lucrative world of premium whisky and wine investment with Oeno Group today.

Get Started Today

Partner with the best wine and whisky investment company in Australia

Fine wine and whisky have long been a cherished pleasure in many households. And only more recently, investors and collectors have realised the true potential of these assets. Fine wine and whisky have seen exceptional growth over the last few years. Barclays Wealth and Investment Management note that 33% of high-net-worth individuals include fine wine in their portfolio, dedicating approximately 2% of their wealth to these endeavours.

Recognising the impressive and persistent track record of these assets, Oeno Group was born in 2015. Our mission, originally, was to curate bespoke and prestigious wine collections to ensure nature’s best was accessible to all. While initially understood as a fine wine investment company, we are proud to have expanded into the whisky market, guiding clients through the exciting and promising world of premium and wine investment.

As a premier wine and whisky investment company in Australia, our dedicated team knows a thing or two about these esteemed assets. Oeno Group takes great pride in educating our clients on the benefits of wine and whisky investment, combining our passion for the tipple with data-rich market insights.

Why invest in premium wine and whisky?

Tangible assets with inherent value

Minimal correlation with traditional markets

Appreciation

potential

Enjoyment and prestige

Explore the rewards and complexities of Australia’s most up-and-coming market

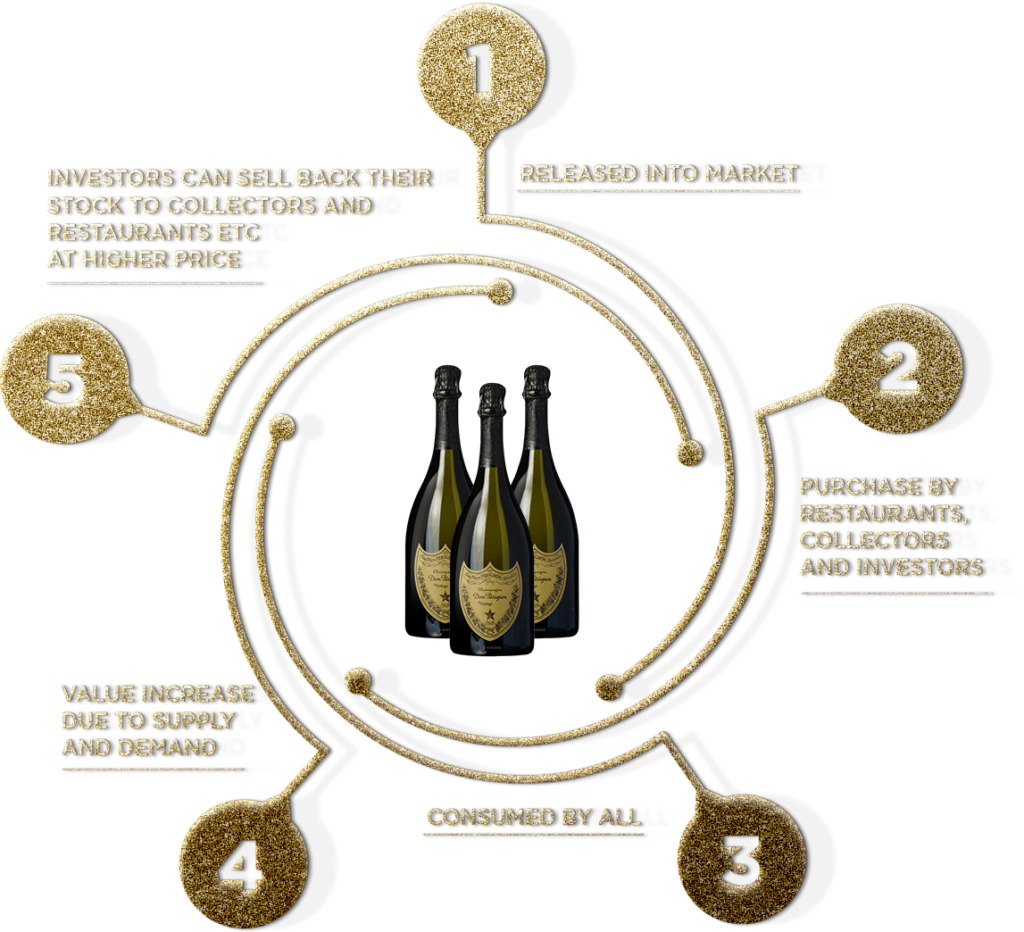

Australia is the fifth largest wine exporter in the world. Imagine the return investors could experience by utilising the movement of a humble bottle of red. Gain ample market exposure, safeguard yourself against economic uncertainty and explore a world that knows no bounds in taste and creativity — investing in luxury can potentially deliver quality returns.

Investing in fine wine and premium whisky is not without its complexities. Market knowledge, understanding the ageing process and awareness of global demand shifts are crucial. Understanding the factors that drive value in wine and whisky, from production methods to regional variations, can inform smarter investment decisions.

It’s also worth noting that wine and whisky investments typically require a long-term outlook. The most significant returns are often realised over many years as rarity and desirability increase. Diversification is also essential. Investing in various wines and whiskies from different regions, producers and vintages can help mitigate risk and maximise potential returns.

Our Returns

Between 2019 and 2022, we’ve helped our clients achieve incredible returns from their wine and whisky investments.

2019

11.02%

2020

12.10%

2021

15.56%

2022

15.35%

Our Awards

Oeno Group is proud to be a trailblazer within the wine and whisky investment industry, and our commitment to providing unwavering quality and customer service has seen us as the recipient of numerous accolades, from the 2023 Investor Awards to Lux Life.

Get started today with Oeno Group, Australia’s premium whisky investment company

Partnering with Oeno Group for your wine and whisky investment opens doors of possibilities, from exclusive tasting events to further expand your understanding to owning a remarkable collection that spans international waters.

Join a passionate community of like-minded investors and enjoy access to an esteemed fine wine and whisky collection that cannot be found anywhere else. For more information about investment opportunities through Oeno Group, please contact us today.

Client Reviews

Great alternative investment

Great time meeting and drinking some very nice wine with your experts. Really fun to sit and discuss the long term appreciation of different wines and whisky.

Blake

Verified

Such a good day at OenoHouse

I had such a good day when I recently visited OenoHouse with some of my pals. It was a really enjoyable experience which involved us tasting some great wine! We will definitely be going back there when we are all next free again!

Mac

Verified

Meet my portfolio manager

It was my chance to meet my portfolio manager Sid, and he answered all my questions, making me feel more conforfortable about progressing with it. Although it rained at OENO house, it was a good and relaxing atmosphere.

John

Verified

Subscribe to our Newsletter

As Featured On

Investment News

After several years of underperformance, there are finally signs that the Rhône might be stirring. The Rhône 100 has risen just 70.3% since inception, compared with the Liv-ex 1000’s 246.8%...Read More

Another fascinating week across global markets — from record-breaking gold to the first real signs of strain in the UK economy, and even whispers of peace in Gaza helping calm...Read More