Fine wine and whisky investment with Oeno Group — how it works

Welcome to the world of fine wine and whisky investment, where years of tradition meet modern opportunities and every bottle tells a story of heritage, craftsmanship and potential growth.

At Oeno Group, we believe that investing in wine and whisky offers a unique opportunity to indulge in a rich market and diversify your portfolio. We can help you enjoy substantial returns and discover a market that’s as fruitful as it is intoxicating. Explore our process and schedule a consultation with one of our wine and whisky experts today.

Introduction

Over the past few decades, fine wine and whisky have proved themselves as highly profitable alternative asset classes, making it an attractive addition to many portfolios. A 2019 survey by Barclays Wealth and Investment Management revealed that over 33% of high-net-worth individuals have fine wine as part of their portfolio, allocating roughly 2% of their wealth in these collections. With rising market uncertainties and fears of recession, conscientious investors have quickly realised how fine wine and whisky’s unique attributes offer incredible growth potential for returns and are an intelligent way to diversify your portfolio.

The primary motivation to collect fine wine and whisky lies in its stable yet impressive track record. As they are both asset-backed, fine wine and whisky are often compared to gold and is rarely affected by fluctuations of the stock market.

Why invest in fine wine and whisky

Whether you appreciate the taste of a malty whisky or admire the aroma of a classic bottle of red, fine wine and whisky investment allows you to take your love for the drop further. Investing in whisky and wine opens the door to incredible opportunities, particularly for investors seeking asset diversification while navigating the waters of market uncertainty.

The evolving success of Australian wineries in international markets has inspired investors to take advantage of this niche and tangible market. Meanwhile, a recent report from the Australian Distillers Association reveals that whisky remains Australia’s biggest exported spirit, worth $165 million in the 2018-19 financial year and representing 46% of all exported spirits — that number has only been expected to increase as more investors from around the globe recognise the value of this dignified drink.

Here are a few reasons why our clients have added fine wine and whisky investment to their portfolios:

Diversification

As an investor, investigating strategies to minimise risk and amplify returns is essential for long-lasting profits. Wine and whisky investments can diversify your portfolio, reducing risk and potentially smoothing out volatility in more traditional investments.

Appreciation potential

Regardless of global economic fluctuations and market sentiment, these luxury assets always remain in demand. Not to mention that fine wines and whiskies have shown to appreciate over time, often outperforming traditional investments, such as stocks or bonds.

Tangible assets

Unlike stocks or digital currencies, wine and whisky are tangible assets you can see, touch and enjoy. Many investors choose to display their collections in their homes for guests to admire or to store their goods in premium storage solutions to maintain their authenticity and quality. Regardless of how you choose to appreciate your wine or whisky, there’s no mistaking the enjoyment of collecting them.

Passion investment

Fine wine and whisky acquisition presents the opportunity to invest in something you are passionate about, combining personal pleasure with financial gains. Oeno Group helps you uncork the potential of one of Australia’s most extraordinary markets.

How to invest in wine and whisky — the Oeno Group process

While wine investment was previously our primary focus, we have since expanded into the whisky industry, guiding investors through the process. Here’s a closer look at how we work:

01

Personal consultation

Your wine and whisky investment journey begins with a personal consultation with one of our experts. We discuss your investment goals, preferences and budget to tailor a strategy that suits your needs. We understand the wine and whisky investment market is uncharted territory for many investors, which is why we take the time to explore the rewards and risks involved for you.

02

Receive a curated collection

Using our market insights and networks, your assigned expert will curate a selection of bespoke wines and whiskies that match your investment profile. Our selections are based on rigorous analysis, product origin and potential for appreciation.

03

Acquisition

Once you’ve made your selections, we handle the acquisition process, ensuring quality and credibility with relevant certificates of authenticity. Our relationships with vineyards, distilleries and auctions allow us to source the best investments for you.

04

Portfolio management

Our service doesn’t end with acquisition, nor do you have to part ways with your assigned consultant. Oeno Group provides ongoing portfolio management, including performance tracking and advice on when to hold or sell your investments.

05

Storage and insurance

Proper storage is crucial to maintaining and enhancing the value of your investment. We offer secure, climate-controlled storage solutions and comprehensive insurance coverage to protect your assets. All our wines are stored in facilities with an average temperature maintained at 13 degrees with 60-65% humidity and minimal exposure to light and movement.

06

Exit strategy

When the time is right, we assist with selling your investments, aiming to maximise returns. Whether through auctions, private sales or our extensive network, we guide you through the exit process.

Our Awards

Our Exit Strategies

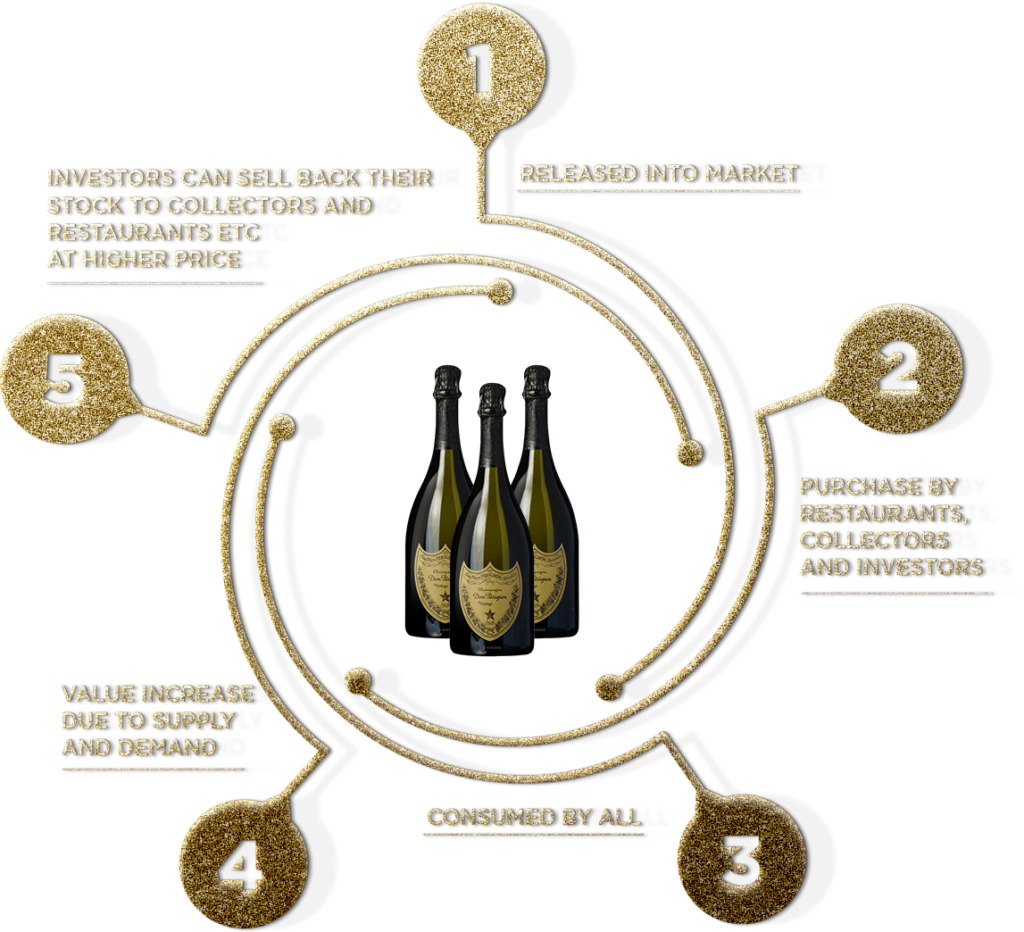

Fine wine & whisk are two of the rarest asset classes with a full circle life-cycle. This means they are produced in limited quantity, collected, and ultimately consumed. Therefore, a comprehensive exit strategy is absolutely imperative to showing your returns from your collection.

Oeno Group is structured to optimise the opportunities in both fine wine & whisky. Clients have access to the world’s finest and rarest of both of these asset classes via OenoFuture, and they enjoy access to customised exit strategies through UK hospitality via OenoTrade, or through our e-commerce platforms and our luxury boutique OenoHouse.

Retail Buyers from OENO House

Torem ipsum dolor sit amet, consectetur adipiscing elit. Nunc vulputate libero et velit interdum, ac aliquet odio mattis.

Hospitality Customers from OENO Trade

Torem ipsum dolor sit amet, consectetur adipiscing elit. Nunc vulputate libero et velit interdum, ac aliquet odio mattis.

OENO’s E-Commerce

Torem ipsum dolor sit amet, consectetur adipiscing elit. Nunc vulputate libero et velit interdum, ac aliquet odio mattis.

OENO’s Exchange

Torem ipsum dolor sit amet, consectetur adipiscing elit. Nunc vulputate libero et velit interdum, ac aliquet odio mattis.

Ready to get started?

Get in touch with Oeno Group today

Test the potential of fine whisky and wine investment in Australia for yourself with Oeno Group. Whether you’re a seasoned collector or new to the world of fine wine and spirits, Oeno Group is here to guide you through every step of the process, attending to any queries you have. Contact us today for a personal consultation and discover how we can help you achieve your investment goals.

Our Storage

London City Bond (LCB) specialises in storing fine wines for the trade and private clients in purpose-designed warehouses in the UK. Its roots can be traced back to 1870 when British & Foreign Wharf was established in the Port of London to offer bonded warehouse services to the 19th century wine and spirit trade. Today LCB is the largest privately-owned bonded warehousing firm in the UK responsible for 7 million cases of wine in their 1.6 million square feet of warehouse space. It stores wine for most of the country’s biggest wine merchants and private clients from all over the world.

Comprehensive Insurance Coverage

London City Bond (LCB) specialises in storing fine wines for the trade and private clients in purpose-designed warehouses in the UK. Its roots can be traced back to 1870 when British & Foreign Wharf was established in the Port of London to offer bonded warehouse services to the 19th century wine and spirit trade. Today LCB is the largest privately-owned bonded warehousing firm in the UK responsible for 7 million cases of wine in their 1.6 million square feet of warehouse space. It stores wine for most of the country’s biggest wine merchants and private clients from all over the world.

FAQs

Starting investments in wine and whisky can vary widely, but typically, an initial investment of $2,000 to $5,000 can provide access to a range of promising bottles or casks. This flexible amount allows for the purchase of several quality bottles of wine or whisky and allows for generous and diversified market exposure.

However, wines from prestigious regions, like Bordeaux and Burgundy, rare vintages and bottles from acclaimed producers do have the push to exceed in value. Limited edition releases and wines with high scores from respected critics also tend to appreciate over time.

Yes, whether you’re buying wine for investment purposes or simply exploring the potential of whisky, Oeno Group understands everyone has different financial goals. By selecting from a diverse array of wines and whiskies, we can tailor your investments to suit your taste and target specific returns to achieve a balanced and satisfying portfolio.

Oeno Group is proud to have a healthy track record of securing positive returns for our clients. In 2022, Panton Accountancy Services Limited confirmed that Oeno Group helped clients achieve an average return of 15.35% with fine wine and whisky investments.